PNC Bank 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

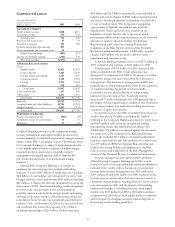

32

REGIONAL COMMUNITY BANKING

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2001 2000

INCOME STATEMENT

Net interest income $1,466 $1,414

Other noninterest income 679 608

Net securities

g

ains 86 11

T

otal revenue 2,231 2,033

Provision for credit losses 50 45

Noninterest ex

p

ense 1,099 1,071

Vehicle leasin

g

135

Asset im

p

airment and severance costs 13

Pretax earnin

g

s934 917

Income taxes 338 327

Earnin

g

s$596 $590

AVERAGE BALANCE

S

HEET

Loans

Consumer

Home equity $6,293 $5,419

Indirect automobile 814 1,215

Other consumer 835 897

Total consumer 7,942 7,531

Residential mortgage 7,912 11,619

Commercial 3,557 3,649

Vehicle leasing 1,901 1,322

Other 133 144

Total loans 21,445 24,265

Securities available for sale 10,241 5,539

Loans held for sale 1,293 1,297

Assigned assets and other assets 7,306 7,857

Total assets $40,285 $38,958

Deposits

Noninterest-bearing demand $4,571 $4,548

Interest-bearing demand 5,713 5,428

Money market 12,162 10,253

Total transaction deposits 22,446 20,229

Savings 1,870 1,992

Certificates 11,906 13,745

Total deposits 36,222 35,966

Other liabilities 1,345 363

Assigned capital 2,718 2,629

Total funds $40,285 $38,958

P

ERFORMANCE

R

ATIO

S

Return on assigned capital 22% 22%

Noninterest income to total revenue 34 30

Efficiency 54 51

Regional Community Banking provides deposit, branch-based

brokerage, electronic banking and credit products and services

to retail customers as well as deposit, credit, treasury

management and capital markets products and services to

small businesses primarily within PNC’s geographic region.

Regional Community Banking’s strategic focus is on

driving sustainable revenue growth, aggressively managing

the revenue/expense relationship and improving the

risk/return dynamic of this business. Regional Community

Banking utilizes knowledge-based marketing capabilities to

analyze customer demographic information, transaction

patterns and delivery preferences to develop customized

banking packages focused on improving customer

satisfaction and profitability.

Regional Community Banking has also invested heavily

in building a sales culture and infrastructure while improving

efficiency. Capital investments have been strategically

directed towards the expansion of multi-channel distribution,

consistent with customer preferences, as well as the delivery

of relevant customer information to all distribution channels.

In the fourth quarter of 2001, the Corporation made the

decision to discontinue its vehicle leasing business. This

portfolio is expected to mature over a period of

approximately five years. Costs incurred in 2001 to exit this

business and additions to reserves related to insured residual

value exposures totaled $135 million. See Strategic

Repositioning and Critical Accounting Policies and

Judgments in the Risk Factors section of this Financial

Review for additional information. Also, pretax charges of

$13 million were incurred for asset impairment and

severance costs related to other strategic initiatives.

Regional Community Banking earnings were $596 million

in 2001 compared with $590 million in 2000.

Total revenue increased 10% to $2.231 billion for 2001.

Excluding net securities gains from both periods, revenue

increased 6% in the period-to-period comparison primarily

due to higher consumer transaction deposit activity in 2001,

gains on sales of residential mortgage loans and sales of

student loans in repayment.

The provision for credit losses for 2001 was $50 million

compared with $45 million for 2000. See Critical Accounting

Policies and Judgments in the Risk Factors section and

Credit Risk in the Risk Management section of this Financial

Review for additional information.

Total loans decreased in the comparison primarily due to

the reduction of residential mortgage loans resulting from

sales and securitizations and the continued downsizing of the

indirect automobile lending portfolio. Securities available for

sale increased in the year-to-year comparison due to the

retention of interests from the securitization of residential

mortgage loans combined with net securities purchases for

balance sheet and interest rate risk management activities.

Transaction deposits grew 11% on average in the

comparison primarily driven by an increase in money market

deposits that resulted from targeted consumer marketing

initiatives to add new accounts and retain existing customers

as higher cost certificates of deposit were de-emphasized.