PNC Bank 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

The principal source of parent company revenue and

cash flow is the dividends it receives from PNC Bank. The

bank’s dividend level may be impacted by its capital needs,

supervisory policies, corporate policies, contractual

restrictions and other factors. Also, there are legal limitations

on the ability of national banks to pay dividends or make

other capital distributions. PNC Bank was not permitted to

pay dividends to the parent company as of December 31,

2001 without prior approval from banking regulators as a

result of the repositioning charges taken in 2001 and prior

dividends. Under these limitations, PNC Bank’s capacity to

pay dividends without prior regulatory approval can be

restored through retention of earnings. Management expects

PNC Bank’s dividend capacity relative to such legal

limitations to be restored during 2002 from retained

earnings.

In addition to dividends from PNC Bank, other sources

of parent company liquidity include cash and short-term

investments, as well as dividends and loan repayments from

other subsidiaries. As of December 31, 2001, the parent

company had approximately $800 million in funds available

from its cash and short-term investments or other funds

available from unrestricted subsidiaries. Management

believes the parent company has sufficient liquidity available

from sources other than dividends from PNC Bank to meet

current obligations to its debt holders, vendors, and others

and to pay dividends at current rates through 2002.

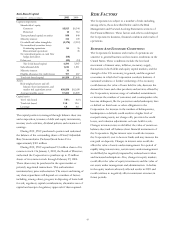

The following tables set forth contractual obligations and various commitments representing required and potential cash

outflows as of December 31, 2001.

Contractual Obligations Payment Due By Period

December 31, 2001 - in millions Total

Less than one

year

One to three

years

Four to five

years

After five

years

Minimum annual rentals on noncancellable leases $908 $125 $220 $181 $382

Remaining contractual maturities of time deposits 12,773 8,718 2,456 1,110 489

Borrowed funds 12,090 3,382 4,482 2,742 1,484

Capital securities of subsidiary trusts (a) 848 848

Total contractual cash obligations $26,619 $12,225 $7,158 $4,033 $3,203

(a) Reflects the maturity of junior subordinated debentures held by subsidiary trusts.

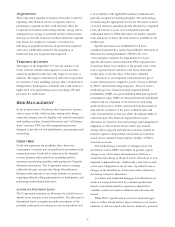

Other Commitments (a) Total Amount Of Commitment Expiration By Period

December 31, 2001 - in millions

Amounts

Committed

Less than one

year

One to three

years

Four to five

years

After five

years

Standby letters of credit $3,998 $2,102 $1,727 $156 $13

Loan commitments 25,279 15,507 6,632 2,808 332

Asset-backed commercial

p

a

p

er condui

t

5,764 5,713 51

Other commitments (b) 247 9 211 27

T

otal commitments $35,288 $23,331 $8,621 $2,991 $345

(a) Commitments are funding commitments that could potentially require performance in the event of demands by third parties or contingent events. Loan commitments are reported

net of participations, assignments and syndications.

(b) Equity Management funding commitments.

TRADING ACTIVITIES

Most of PNC’s trading activities are designed to provide

capital markets services to customers and not to position the

Corporation’s portfolio for gains from market movements.

Trading activities are confined to financial instruments and

financial derivatives. PNC participates in derivatives and

foreign exchange trading as well as underwriting and “market

making” in equity securities as an accommodation to

customers. PNC also engages in trading activities as part of

risk management strategies. Net trading income was $147

million in 2001 compared with $91 million in 2000. See Note

7 Trading Activities for additional information.

Risk associated with trading, capital markets and foreign

exchange activities is managed using a value-at-risk approach

that combines interest rate risk, foreign exchange rate risk,

spread risk and volatility risk. Using this approach, exposure

is measured as the potential loss due to a two standard

deviation, one-day move in interest rates. The estimated

average combined value-at-risk of all trading operations

using this measurement was $.7 million for both 2001 and

2000. The estimated combined period-end value-at-risk was

$.9 million at December 31, 2001 and $.5 million at

December 31, 2000.