PNC Bank 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

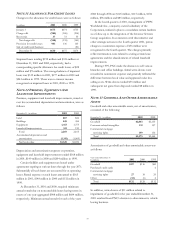

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Corporation uses a variety of financial derivatives as part

of the overall asset and liability risk management process to

manage interest rate, market and credit risk inherent in the

Corporation’s business activities. Substantially all such

instruments are used to manage risk related to changes in

interest rates. Interest rate and total rate of return swaps,

purchased interest rate caps and floors and futures contracts

are the primary instruments used by the Corporation for

interest rate risk management.

Interest rate swaps are agreements with a counterparty to

exchange periodic fixed and floating interest payments

calculated on a notional amount. The floating rate is based

on a money market index, primarily short-term LIBOR.

Total rate of return swaps are agreements with a

counterparty to exchange an interest rate payment for the

total rate of return on a specified reference index calculated

on a notional amount. Purchased interest rate caps and floors

are agreements where, for a fee, the counterparty agrees to

pay the Corporation the amount, if any, by which a specified

market interest rate exceeds or is less than a defined rate

applied to a notional amount, respectively. Interest rate

futures contracts are exchange-traded agreements to make or

take delivery of a financial instrument at an agreed upon

price and are settled in cash daily.

Financial derivatives involve, to varying degrees, interest

rate, market and credit risk. The Corporation manages these

risks as part of its asset and liability management process and

through credit policies and procedures. The Corporation

seeks to minimize the credit risk by entering into transactions

with only a select number of high-quality institutions,

establishing credit limits, and generally requiring bilateral

netting and collateral agreements.

As required, effective January 1, 2001, the Corporation

implemented SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” as amended by SFAS

No. 137 and No. 138. The statement requires the

Corporation to recognize all derivative instruments at fair

value as either assets or liabilities. Financial derivatives are

reported at fair value in other assets or other liabilities. The

accounting for changes in the fair value of a derivative

instrument depends on whether it has been designated and

qualifies as part of a hedging relationship. For derivatives not

designated as hedges, the gain or loss is recognized in current

earnings.

For those derivative instruments that are designated and

qualify as hedging instruments, the Corporation must

designate the hedging instrument, based on the exposure

being hedged, as either a fair value hedge, a cash flow hedge

or a hedge of a net investment in a foreign operation. The

Corporation has no derivatives that hedge the net investment

in a foreign operation.

For derivatives that are designated as fair value hedges

(i.e., hedging the exposure to changes in the fair value of an

asset or a liability attributable to a particular risk), the gain or

loss on derivatives as well as the loss or gain on the hedged

items are recognized in current earnings. An adjustment to

the hedged item for the change in its fair value pertaining to

the hedged risk is included in its carrying value. For

derivatives designated as cash flow hedges (i.e., hedging the

exposure to variability in expected future cash flows), the

effective portions of the gain or loss on derivatives are

reported as a component of accumulated other

comprehensive income and recognized in earnings in the

same period or periods during which the hedged transaction

affects earnings. Any remaining gain or loss on these

derivatives is recognized in current earnings.

Fair Value Hedging Strategies

The Corporation enters into interest rate and total rate of

return swaps, caps, floors and interest rate futures derivative

contracts to hedge designated commercial mortgage loans

held for sale, securities available for sale, commercial loans,

bank notes, senior debt and subordinated debt for changes in

fair value primarily due to changes in interest rates.

Adjustments related to the ineffective portion of fair value

hedging instruments are recorded in interest income, interest

expense or noninterest income depending on the hedged

item.

Cash Flow Hedging Strategy

The Corporation enters into interest rate swap contracts to

modify the interest rate characteristics of designated

commercial loans from variable to fixed in order to reduce

the impact of interest rate changes on future interest income.

The fair value of these derivatives is reported in other assets

or other liabilities and offset in accumulated other

comprehensive income for the effective portion of the

derivatives. Amounts reclassed into earnings, when the

hedged transaction culminates, are included in interest

income. Ineffectiveness of the strategy, as defined under

SFAS No. 133, if any, is reported in interest income.

Customer And Other Derivatives

To accommodate customer needs, PNC also enters into

financial derivative transactions primarily consisting of

interest rate swaps, caps, floors and foreign exchange

contracts. Market risk exposure from customer positions are

managed through transactions with other dealers. The credit

risk associated with derivatives executed with customers is