PNC Bank 2001 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

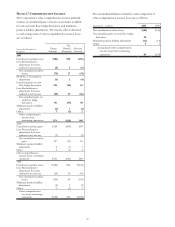

NET LOANS AND LOANS HELD FOR SALE

Fair values are estimated based on the discounted value of

expected net cash flows incorporating assumptions about

prepayment rates, credit losses and servicing fees and costs.

For revolving home equity loans, this fair value does not

include any amount for new loans or the related fees that will

be generated from the existing customer relationships. In the

case of nonaccrual loans, scheduled cash flows exclude

interest payments. The carrying value of loans held for sale

approximates fair value.

COMMERCIAL MORTGAGE SERVICING RIGHTS

The fair value of commercial mortgage servicing rights is

estimated based on the present value of future cash flows.

These fair values are based on assumptions as to prepayment

speeds, discount rate and the weighted-average life of the

related commercial loans.

DEPOSITS

The carrying amounts of noninterest-bearing demand and

interest-bearing money market and savings deposits

approximate fair values. For time deposits, which include

foreign deposits, fair values are estimated based on the

discounted value of expected net cash flows assuming

current interest rates.

BORROWED FUNDS

The carrying amounts of federal funds purchased,

commercial paper, acceptances outstanding and accrued

interest payable are considered to be their fair value because

of their short-term nature. For all other borrowed funds, fair

values are estimated based on the discounted value of

expected net cash flows assuming current interest rates.

UNFUNDED LOAN COMMITMENTS AND LETTERS OF

CREDIT

Fair values for commitments to extend credit and letters of

credit are estimated based on the amount of deferred fees

and the creditworthiness of the counterparties.

FINANCIAL AND OTHER DERIVATIVES

The fair value of derivatives is based on the discounted value

of the expected net cash flows. These fair values represent

the amounts the Corporation would receive or pay to

terminate the contracts, assuming current interest rates.

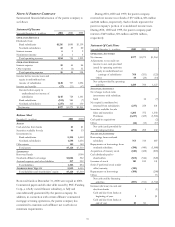

NOTE 29 UNUSED LINE OF CREDIT

At December 31, 2001, the Corporation maintained a line of

credit in the amount of $500 million, none of which was

drawn. This line is available for general corporate purposes

and expires in 2003.

NOTE 30 SUBSEQUENT EVENTS

In January 2002, PNC Business Credit acquired a portion of

the U.S. asset-based lending business of NBOC. As a result

of this acquisition, PNC Business Credit established six new

marketing offices and enhanced its presence as one of the

premier asset-based lenders for the middle market customer

segment. At the acquisition date, credit exposure acquired

was approximately $2.6 billion including $1.5 billion of loan

outstandings. None of the loans were nonperforming at

acquisition.

Additionally, PNC Business Credit agreed to service a

portion of NBOC’s remaining U.S. asset-based loan

portfolio (“serviced portfolio”) for a period of eighteen

months. The serviced portfolio consisted of approximately

$670 million of credit exposure including $463 million of

outstandings as of the acquisition date. At closing, $138

million of these outstandings were classified as

nonperforming. The serviced portfolio’s credit exposure and

outstandings are expected to be reduced through managed

liquidation and runoff during the eighteen-month servicing

period. At the end of the servicing term, NBOC has the right

to transfer the then remaining serviced portfolio to PNC

Business Credit. PNC Business Credit established a liability

of $112 million in 2002 as part of the allocation of the

purchase price to reflect this obligation. The amount of this

liability will be assessed quarterly with any changes

recognized in earnings. During the servicing term, NBOC

will be responsible for realized credit losses with respect to

the serviced portfolio to a maximum of $50 million. If the

right to transfer is exercised, the Corporation is responsible

for realized credit losses on the serviced portfolio that may

occur during the eighteen-month period in excess of certain

NBOC specific reserves related to those assets, when

applicable (available only on specified credits), and the $50

million first loss position. PNC Business Credit management

currently expects the amounts indicated above to be

adequate to cover potential losses in connection with the

serviced portfolio.

On January 3, 2002, the Board of Directors authorized

the Corporation to purchase up to 35 million shares of its

common stock through February 29, 2004. These shares may

be purchased in the open market or privately negotiated

transactions. This authorization terminated any prior

authorization. The extent and timing of any share

repurchases will depend on a number of factors including,

among others, progress in disposing of loans held for sale,

regulatory capital considerations, alternative uses of capital

and receipt of regulatory approvals if then required.