PNC Bank 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

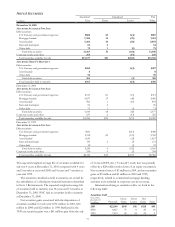

ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses is established through

provisions charged against income. Loans deemed to be

uncollectible are charged against the allowance and

recoveries of previously charged-off loans are credited to the

allowance.

The allowance is maintained at a level believed by

management to be sufficient to absorb estimated probable

credit losses. Management’s determination of the adequacy

of the allowance is based on periodic evaluations of the

credit portfolio and other relevant factors. This evaluation is

inherently subjective as it requires material estimates,

including, among others, expected default probabilities, loss

given default, expected commitment usage, the amounts and

timing of expected future cash flows on impaired loans,

estimated losses on consumer loans and residential

mortgages, and general amounts for historical loss

experience, economic conditions, uncertainties in estimating

losses and inherent risks in the various credit portfolios, all

of which may be susceptible to significant change.

In determining the adequacy of the allowance for credit

losses, the Corporation makes specific allocations to

impaired loans and to pools of watchlist and nonwatchlist

loans for various credit risk factors. Allocations to loan pools

are developed by business segment and risk rating and are

based on historical loss trends and management’s judgment

concerning those trends and other relevant factors. These

factors may include, among others, actual versus estimated

losses, regional and national economic conditions, business

segment and portfolio concentrations, industry competition

and consolidation, and the impact of government

regulations. Consumer and residential mortgage loan

allocations are made at a total portfolio level based on

historical loss experience adjusted for portfolio activity and

economic conditions.

While PNC’s pool reserve methodologies strive to reflect

all risk factors, there continues to be a certain element of risk

associated with, but not limited to, potential estimation or

judgmental errors. Unallocated reserves are designed to

provide coverage for such risks. While allocations are made

to specific loans and pools of loans, the total reserve is

available for all credit losses.

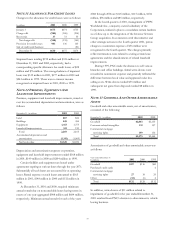

EQUITY MANAGEMENT ASSETS

Equity management assets are included in other assets and

are comprised of limited partnerships and direct investments.

Investments in limited partnerships are valued based on the

financial statements received from the general partner. Direct

investments are carried at estimated fair value. Changes in

the value of these assets are recognized in noninterest

income.

GOODWILL AND OTHER AMORTIZABLE ASSETS

Goodwill is amortized to expense on a straight-line basis

over periods ranging from 15 to 25 years. Other amortizable

assets are amortized to expense using accelerated or straight-

line methods over their respective estimated useful lives. On

a periodic basis, management reviews goodwill and other

amortizable assets and evaluates events or changes in

circumstances that may indicate impairment in the carrying

amount of such assets. If the sum of the expected

undiscounted future cash flows, excluding interest charges, is

less than the carrying amount of the asset, an impairment

loss is recognized. Impairment, if any, is measured on a

discounted future cash flow basis.

Effective January 1, 2002, the Corporation adopted SFAS

No. 142, “Goodwill and Other Intangible Assets,” which

changes the method of recognition and accounting for

goodwill and certain other intangible assets, and SFAS No.

144, “Accounting for the Impairment or Disposal of Long-

lived Assets,” which addresses implementation issues

regarding the impairment of long-lived assets. Refer to

“Recent Accounting Pronouncements” herein for further

discussion of the impact of these new standards.

DEPRECIATION AND AMORTIZATION

For financial reporting purposes, premises and equipment

are depreciated principally using the straight-line method

over their estimated useful lives ranging from one to 39

years. Accelerated methods are used for federal income tax

purposes. Leasehold improvements are amortized over their

estimated useful lives or the respective lease terms,

whichever is shorter.

REPURCHASE AND RESALE AGREEMENTS

Repurchase and resale agreements are treated as

collateralized financing transactions and are carried at the

amounts at which the securities will be subsequently

reacquired or resold, including accrued interest, as specified

in the respective agreements. The Corporation’s policy is to

take possession of securities purchased under agreements to

resell. The market value of securities to be repurchased and

resold is monitored, and additional collateral may be

obtained where considered appropriate to protect against

credit exposure.

TREASURY STOCK

The Corporation records common stock purchased for

treasury at cost. At the date of subsequent reissue, the

treasury stock account is reduced by the cost of such stock

on the first-in, first-out basis.