PNC Bank 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

The amounts contained in this report also include the

restatement of the results for the first quarter of 2001 to

reflect the correction of an error related to the accounting

for the sale of the residential mortgage banking business.

This restatement reduced income from discontinued

operations and net income for 2001 by $35 million.

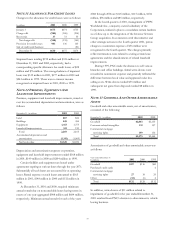

NOTE 4 FOURTH QUARTER ACTIONS

In the fourth quarter of 2001, PNC took several actions to

accelerate the strategic repositioning of its lending businesses

that began in 1998. The Corporation decided to exit

approximately $7.9 billion of credit exposure including $3.1

billion of loan outstandings in the institutional lending

portfolios. Of these amounts, approximately $5.2 billion of

credit exposure and $2.9 billion of loans, respectively, have

been transferred to loans held for sale. The remaining

amounts have been designated for exit and are expected to

run off over the next several years. In connection with the

transfer to held for sale, $653 million of charge-offs and

valuation adjustments were recognized in the fourth quarter.

Additionally, $90 million in charge-offs were taken against

the allowance for credit losses specifically allocated to these

loans.

PNC also made the decision to discontinue its vehicle

leasing business due to continued depressed market

conditions and the increased difficulty and cost of obtaining

residual value insurance protection. The vehicle leasing

business had $1.9 billion in assets at December 31, 2001 that

have been designated for exit and will mature over a period

of approximately five years. Costs incurred in 2001 to exit

this business, including the impairment of goodwill

associated with a prior acquisition and employee severance

costs, and additions to reserves related to insured residual

value exposures totaled $135 million and were charged to

noninterest expense.

The Corporation also recorded charges of $65 million in

the fourth quarter for certain integration, severance and

other costs related to other strategic initiatives.

NOTE 5 SALE OF SUBSIDIARY STOCK

PNC recognizes as income the gain from the sale of stock by

its subsidiaries. The gain is the difference between PNC’s

basis in the stock and the proceeds per share received. PNC

provides applicable taxes on the gain.

In October 1999, BlackRock, Inc. (“BlackRock”), a

majority-owned investment management subsidiary of the

Corporation, issued nine million shares of class A common

stock at $14.00 per share in an initial public offering (“IPO”).

Prior to the IPO, PNC and BlackRock’s management owned

approximately 82% and 18%, respectively, of BlackRock’s

outstanding common stock. Proceeds from the sale were

approximately $115 million and resulted in PNC recording a

pretax gain in the amount of $64 million or $59 million after

tax. As of December 31, 2001, PNC owned approximately

70% of BlackRock.

NOTE 6 CASH FLOWS

For the consolidated statement of cash flows, cash and cash

equivalents are defined as cash and due from banks.

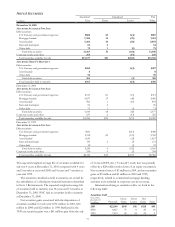

The following table sets forth information pertaining to

acquisitions and divestitures that affected cash flows:

Cash Flows

Year ended December 31 - in millions 2001 2000 1999

Assets divested (acquired) $7,252 $(4) $2,062

Liabilities divested (ac

q

uired) 6,852 (4) 208

Cash

p

aid 18 31 1,407

Cash and due from banks received 503 1 3,261

NOTE 7 TRADING ACTIVITIES

Most of PNC’s trading activities are designed to provide

capital markets services to customers and not to position the

Corporation’s portfolio for gains from market movements.

PNC participates in derivatives and foreign exchange trading

as well as underwriting and “market making” in equity

securities as an accommodation to customers. PNC also

engages in trading activities as part of risk management

strategies.

Net trading income in 2001, 2000 and 1999 included in

noninterest income was as follows:

Details Of Trading Activities

Year ended December 31 - in millions 2001 2000 1999

Corporate services $5 $7

Other noninterest income

Securities underwriting and

trading 55 42 $48

Derivatives trading 61 20 8

Foreign exchange 26 22 17

Net tradin

g

income $147 $91 $73