PNC Bank 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

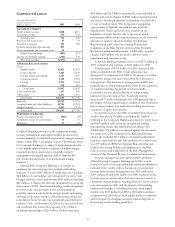

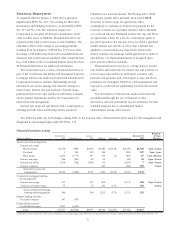

Risk-Based Capital

December 31 - dollars in millions 2001 2000

Capital components

Shareholders’ equity

Common $5,813 $6,344

Preferred 10 312

Trust preferred capital securities 848 848

Minority interest 134 109

Goodwill and other intangibles (2,174) (2,312)

Net unrealized securities losses

Continuing operations 86 35

Discontinued operations 45

Net unrealized gains on cash flow

hedge derivatives (98)

Other, net (20) (14)

Tier I risk-based capital 4,599 5,367

Subordinated debt 1,616 1,811

Minority interest 36

Eligible allowance for credit losses 707 667

Total risk-based capital $6,958 $7,845

Assets

Risk-weighted assets and off-

balance-sheet instruments, and

market risk equivalent assets $58,958 $62,430

Average tangible assets 67,604 66,809

Capital ratios

Tier I risk-based 7.8% 8.6%

Total risk-based 11.8 12.6

Leverage 6.8 8.0

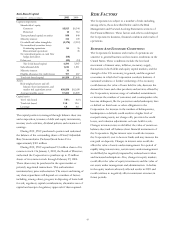

The capital position is managed through balance sheet size

and composition, issuance of debt and equity instruments,

treasury stock activities, dividend policies and retention of

earnings.

During 2001, PNC purchased a portion and redeemed

the balance of the outstanding shares of Fixed/Adjustable

Rate Noncumulative Preferred Stock Series F for

approximately $301 million.

During 2001, PNC repurchased 9.5 million shares of its

common stock. On January 3, 2002, the Board of Directors

authorized the Corporation to purchase up to 35 million

shares of its common stock through February 29, 2004.

These shares may be purchased in the open market or

privately negotiated transactions. This authorization

terminated any prior authorization. The extent and timing of

any share repurchases will depend on a number of factors

including, among others, progress in disposing of loans held

for sale, regulatory capital considerations, alternative uses of

capital and receipt of regulatory approvals if then required.

RISK FACTORS

The Corporation is subject to a number of risks including,

among others, those described below and in the Risk

Management and Forward-Looking Statements sections of

this Financial Review. These factors and others could impact

the Corporation’s business, financial condition and results of

operations.

BUSINESS AND ECONOMIC CONDITIONS

The Corporation’s business and results of operations are

sensitive to general business and economic conditions in the

United States. These conditions include the level and

movement of interest rates, inflation, monetary supply,

fluctuations in both debt and equity capital markets, and the

strength of the U.S. economy, in general, and the regional

economies in which the Corporation conducts business. A

sustained weakness or further weakening of the economy

could decrease the value of loans held for sale, decrease the

demand for loans and other products and services offered by

the Corporation, increase usage of unfunded commitments

or increase the number of customers and counterparties who

become delinquent, file for protection under bankruptcy laws

or default on their loans or other obligations to the

Corporation. An increase in the number of delinquencies,

bankruptcies or defaults could result in a higher level of

nonperforming assets, net charge-offs, provision for credit

losses, and valuation adjustments on loans held for sale.

Changes in interest rates could affect the value of certain on-

balance-sheet and off-balance-sheet financial instruments of

the Corporation. Higher interest rates would also increase

the Corporation’s cost to borrow funds and may increase the

rate paid on deposits. Changes in interest rates could also

affect the value of assets under management. In a period of

rapidly rising interest rates, certain assets under management

would likely be negatively impacted by reduced asset values

and increased redemptions. Also, changes in equity markets

could affect the value of equity investments and the value of

net assets under management and administration. A decline

in the equity markets adversely affected results in 2001 and

could continue to negatively affect noninterest revenues in

future periods.