PNC Bank 2001 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

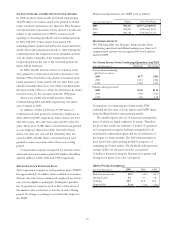

value of $92 million at December 31, 2000. Included in these

amounts were credit default swaps, with notional amounts of

$4.4 billion and negative fair value of $2 million, no longer

considered to be derivatives under SFAS No. 133, due to

their particular structure.

In addition, at December 31, 2000 the Corporation had

financial derivatives for customer-related and other purposes

with notional amounts totaling $31.3 billion and $1.2 billion,

respectively. These derivatives had net fair values of negative

$12 million and positive $12 million, respectively. Total

positive and negative fair value positions within the

customer-related derivatives were $273 million and $285

million, respectively. Total positive and negative fair value

positions for derivatives held for other purposes were $13

million and $1 million, respectively.

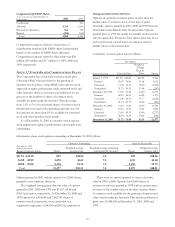

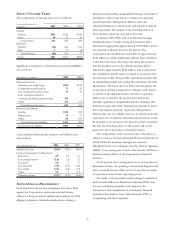

NOTE 21 EMPLOYEE BENEFIT PLANS

PENSION AND POSTRETIREMENT PLANS

The Corporation has a noncontributory, qualified defined

benefit pension plan covering most employees. Retirement

benefits are derived from a cash balance formula based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

The Corporation also maintains nonqualified

supplemental retirement plans for certain employees. All

retirement benefits provided under these plans are unfunded

and any payments to plan participants are made by the

Corporation. The Corporation also provides certain health

care and life insurance benefits for retired employees (“post-

retirement benefits”) through various plans.

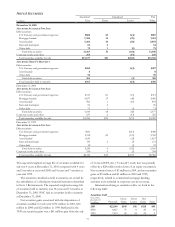

A reconciliation of the changes in the benefit obligation for qualified and nonqualified pension plans and post-retirement benefit

plans as well as the change in plan assets for the qualified pension plan is as follows:

Qualified and

Nonqualified Pensions

Post-retirement

Benefits

December 31 – in millions 2001 2000 2001 2000

Benefit obligation at beginning of year $856 $840 $203 $198

Service cos

t

32 32 22

Interest cos

t

66 65 14 14

Actuarial loss 41 712 7

Settlements

(

20

)

Participant contributions 44

Benefits paid (75) (68) (24) (22)

Benefit obli

g

ation at end of

y

ear $920 $856 $211 $203

Fair value of plan assets at beginning of year $952 $939

Actual loss on plan assets (89) (29)

Employer contribution 140 130

Settlements

(

20

)

Benefits paid (75) (68)

Fair value of

p

lan assets at end of

y

ear $928 $952

Funded status $8 $96 $

(

211

)

$

(

203

)

Unrecognized net actuarial loss (gain) 289 65 (58) 38

Unrecognized prior service credit (3) (5) 54 (63)

Net amount reco

g

nized on the balance shee

t

$294 $156 $

(

215

)

$

(

228

)

Prepaid pension cost $294 $156

Additional minimum liability (21) (18)

Intangible asset 32

Accumulated other comprehensive loss 18 16

Net amount recognized on the balance sheet $294 $156

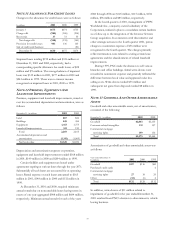

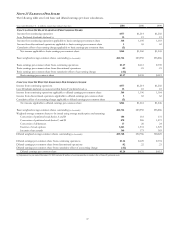

The accrued pension benefit liability above includes $39

million and $34 million for the nonqualified plans at

December 31, 2001 and 2000, respectively. The accumulated

benefit obligation for pension plans with accumulated

benefit obligations in excess of plan assets (the nonqualified

plans) were $60 million and $53 million as of December 31,

2001 and December 31, 2000, respectively. The nonqualified

plans had no plan assets at either date.

Plan assets primarily consist of listed common stocks,

U.S. government and agency securities and various mutual

funds managed by BlackRock from which BlackRock and

PFPC receive compensation for providing investment

advisory, custodial and transfer agency services. Plan assets

are managed by BlackRock and do not include common or

preferred stock of the Corporation.