PNC Bank 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

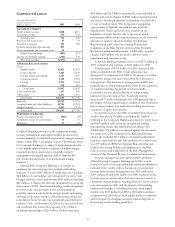

Strategic Repositioning Charges

By Income Statement Caption

Year ended December 31, 2001 – in millions Pretax charges

Provision for credit losses $714

Noninterest income

Corporate services 259

Net securities gains 5

Other 12

Noninterest expense

Staff expense 21

Equipment 1

Other 169

Total $1,181

At December 31, 2001, the institutional lending held for sale

and exit portfolios had a total of $7.7 billion of credit

exposure including $2.8 billion of outstandings. At year end,

$5.0 billion of credit exposure including $2.6 billion of

outstandings was classified as held for sale, net of total

charges of $855 million that represented the excess of

principal balances over the lower of cost or market values.

Details of the credit exposure and outstandings by business

are as follows:

Institutional Lending Held For Sale And Exit Portfolios

December 31, 2001 – in billions

Credit

Exposure Outstandings

LOANS HELD FOR SALE

Corporate Banking $4.6 $2.3

PNC Real Estate Finance .3 .2

PNC Business Credit .1 .1

Total loans held for sale 5.0 2.6

EXIT

Corporate Banking 2.6 .2

PNC Real Estate Finance .1

Total exit 2.7 .2

Total $7.7 $2.8

In the first quarter of 2001, PNC closed the sale of its

residential mortgage banking business. Certain closing date

adjustments are currently in dispute between PNC and the

buyer, Washington Mutual Bank, FA. The ultimate financial

impact of the sale cannot be determined until the disputes

are resolved. See Note 24 Legal Proceedings for additional

information.

See Strategic Repositioning in the Risk Factors section of

this Financial Review for additional information regarding

certain risks associated with executing these strategies.

RESTATEMENTS

Subsequent to year end, PNC announced two changes that

affected 2001 results. During 2001, the Corporation entered

into transactions with subsidiaries of a third party financial

institution (American International Group, Inc.) involving

the sale of loans and venture capital investments and the

receipt of preferred interests in the subsidiaries.

At the time of the transactions, the loans and venture

capital investments were removed from PNC’s balance sheet

and the preferred interests in the entities were recorded as

securities available for sale in conformity with accounting

guidance received from PNC’s independent auditors. In

January 2002, the Federal Reserve Board staff advised PNC

that under generally accepted accounting principles the

subsidiaries of the third party financial institution should be

consolidated into the financial statements of PNC in

preparing bank holding company reports. After considering

all the circumstances, PNC restated its consolidated financial

statements for the second and third quarters of 2001 to

conform financial reporting with regulatory reporting

requirements. All amounts appearing in this report reflect the

consolidation of these entities.

Loans in these entities are included in the consolidated

balance sheet as loans held for sale and are carried at the

lower of cost or market value. Charges recorded at the dates

the assets were sold into the entities were reflected as charge-

offs on those loans in portfolio and as valuation adjustments

in noninterest income on loans previously classified as held

for sale. Subsequent charges to adjust the carrying value of

the loans held for sale were also reflected as valuation

adjustments.

The amounts contained in this report also include the

restatement of the results for the first quarter of 2001 to

reflect the correction of an error related to the accounting

for the sale of the residential mortgage banking business.

This restatement reduced income from discontinued

operations and net income for 2001 by $35 million.

See Note 3 Restatements for additional information.

SUMMARY FINANCIAL RESULTS

Consolidated net income for 2001 was $377 million or $1.26

per diluted share. Excluding the effect of adopting the new

accounting standard for financial derivatives, net income was

$382 million or $1.28 per diluted share compared with $1.279

billion or $4.31 per diluted share for 2000. Income from

continuing operations in 2001 was $377 million or $1.26 per

diluted share compared with $1.214 billion or $4.09 per

diluted share in 2000. Income from discontinued operations

was $5 million or $.02 per diluted share in 2001 compared

with $65 million or $.22 per diluted share in 2000. Results for

2001 reflect the actions taken during the year to accelerate the

repositioning of PNC’s lending businesses and other strategic

initiatives. These charges, totaling $1.2 billion pretax, reduced

2001 net income by $768 million or $2.65 per diluted share.

Return on average common shareholders’ equity was

5.65% and return on average assets was .53% for 2001

compared with 21.63% and 1.68%, respectively, for 2000.