PNC Bank 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

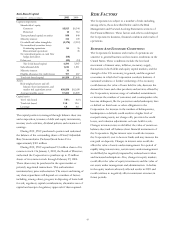

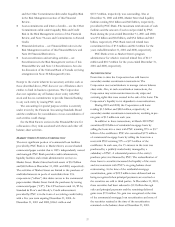

Interest Sensitivity Analysis

December 31 2001 2000

Net Interest Income Sensitivity Simulation

Effect on net interest income from

gradual interest rate change over

following 12 months of:

100 basis point increase (.3)% (.3)%

100 basis point decrease (2.8)% .4%

Economic Value of Equity Sensitivity Model

Effect on value of on- and off-balance-

sheet positions as a percentage of

assets from instantaneous change in

interest rates of:

200 basis point increase (1.4)% (.8)%

200 basis point decrease .5% (.1)%

Key Period-End Interest Rates

One month LIBO

R

1.87% 6.56%

Three-year swap 4.33% 5.89%

Current market interest rates, which are used as base rates in

the Corporation’s net interest income simulation and

economic value of equity models, have declined significantly

from year-end 2000 to year-end 2001.

The major sources of the change in net interest income

sensitivities from 2000 to 2001 are the effects of this decline

in rates on two of the key drivers of the simulation results.

First, the decline in market rates and the lowering of the

rates paid by PNC on transaction deposits have reduced the

expected impact that further rate declines could have on the

rate paid on transaction deposits. Second, the lower rate

environment has increased the effect that a further rate

decline could have on the anticipated prepayment rates of

mortgage-related assets.

Over the course of 2001, management has taken actions

to mitigate the adverse effects of significantly declining

interest rates on the Corporation’s net interest income.

Without these actions, the Corporation’s reported sensitivity

to a 100 basis point decline in interest rates at year end 2001

would have been significantly higher. These actions included

purchasing fixed-rate securities and financial derivatives. The

effects of these actions have contributed to the year-over-

year change in the Corporation’s economic value of equity

sensitivities. Thus far in 2002, management’s actions have

focused on reducing the effects of significantly higher

interest rates on the Corporation’s net interest income and

economic value of equity.

LIQUIDITY RISK

Liquidity represents the Corporation’s ability to obtain cost-

effective funding to meet the needs of customers as well as

the Corporation’s financial obligations. Liquidity is centrally

managed by Asset and Liability Management, with oversight

provided by the Corporate Asset and Liability Committee

and the Finance Committee of the Board of Directors.

The Corporation’s main sources of funds to meet its

liquidity requirements are access to the capital markets, sale

of liquid assets, secured advances from the Federal Home

Loan Bank, its core deposit base and the capability to

securitize assets for sale.

Access to capital markets is a key factor affecting liquidity

management. Access to such markets is in part based on the

Corporation’s credit ratings, which are influenced by a

number of factors including capital ratios, asset quality and

earnings. Additional factors that impact liquidity include the

maturity structure of existing assets, liabilities, and off-

balance-sheet positions, the level of liquid securities and

loans available for sale, regulatory capital classification, and

the Corporation’s ability to securitize and sell various types

of loans.

Liquid assets consist of short-term investments and

securities available for sale. At December 31, 2001, such

assets totaled $14.9 billion, with $6.2 billion pledged as

collateral for borrowings, trust and other commitments.

Secured advances from the Federal Home Loan Bank, of

which PNC Bank, N.A. (“PNC Bank”), PNC’s principal

bank subsidiary, is a member, are generally secured by

residential mortgages, other real-estate related loans and

mortgage-backed securities. At December 31, 2001,

approximately $10.6 billion of residential mortgages and

other real-estate related loans were available as collateral for

borrowings from the Federal Home Loan Bank. Funding can

also be obtained through alternative forms of borrowing,

including federal funds purchased, repurchase agreements

and short-term and long-term debt issuances.

Liquidity for the parent company and subsidiaries is also

generated through the issuance of securities in public or

private markets and lines of credit. At December 31, 2001,

the Corporation had unused capacity under effective shelf

registration statements of approximately $3.3 billion of debt

or equity securities and $400 million of trust preferred capital

securities. The Corporation had an unused line of credit of

$500 million at December 31, 2001.