PNC Bank 2001 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

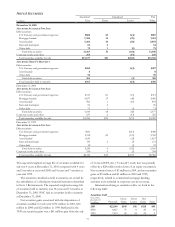

STOCK OPTIONS

Stock options are granted at exercise prices not less than the

fair market value of common stock on the date of grant. No

compensation expense is recognized on such stock options.

RECENT ACCOUNTING PRONOUNCEMENTS

As stated previously, the Corporation adopted SFAS No. 133

effective January 1, 2001. As a result, the Corporation

recognized an after-tax loss from the cumulative effect of a

change in accounting principle of $5 million, which is

reported in the consolidated statement of income for the

year ended December 31, 2001, and an after-tax accumulated

other comprehensive loss of $4 million. Refer to “Derivative

Instruments and Hedging Activities” herein and to Note 20

Financial Derivatives for additional detail on the accounting

for derivative instruments held by the Corporation.

SFAS No. 140, “Accounting for Transfers and Servicing

of Financial Assets and Extinguishments of Liabilities,” was

issued in September 2000 and replaced SFAS No. 125.

Although SFAS No. 140 has changed many of the rules

regarding securitizations, it continues to require an entity to

recognize the financial and servicing assets it controls and

the liabilities it has incurred and to derecognize financial

assets when control has been surrendered in accordance with

the criteria provided in the standard. As required, the

Corporation applied the new rules prospectively to

transactions consummated beginning in the second quarter

of 2001. SFAS No. 140 requires certain disclosures

pertaining to securitization transactions effective for fiscal

years ending after December 15, 2000. These disclosures are

included in Note 14 Securitizations.

In July 2001, the Financial Accounting Standards Board

(“FASB”) issued SFAS No. 141, “Business Combinations.”

SFAS No. 141 requires the purchase method of accounting be

used for all business combinations initiated or completed after

June 30, 2001 and eliminates the pooling-of-interests method

of accounting. The statement also addresses disclosure

requirements for business combinations and initial recognition

and measurement criteria for goodwill and other intangible

assets as a result of purchase business combinations.

While SFAS No. 141 will affect how future business

combinations, if undertaken, are accounted for and disclosed in

the financial statements, the issuance of the new standard had

no effect on the Corporation’s results of operations, financial

position, or liquidity during 2001.

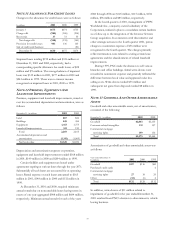

Also in July 2001, the FASB issued SFAS No. 142,

“Goodwill and Other Intangible Assets,” which changes the

accounting from amortizing goodwill to an impairment-only

approach. The amortization of goodwill, including goodwill

recognized relating to past business combinations, will cease

upon adoption of the new standard. Impairment testing for

goodwill at a reporting unit level will be required on at least an

annual basis. The new standard also addresses other accounting

matters, disclosure requirements and financial statement

presentation issues relating to goodwill and other intangible

assets.

The Corporation adopted SFAS No. 142 effective January

1, 2002. Assuming no impairment adjustments are necessary,

no future business combinations and no other changes to

goodwill, the Corporation expects net income to increase by

approximately $93 million in 2002 resulting from the cessation

of goodwill amortization. The Corporation currently does not

have any other indefinite-lived assets on its balance sheet, nor

does it anticipate any material reclassifications or adjustments to

the useful lives of finite-lived intangible assets as a result of

adopting the new standard.

In August 2001, the FASB issued SFAS No. 143,

“Accounting for Asset Retirement Obligations,” which

requires that the fair value of a liability be recognized when

incurred for the retirement of a long-lived asset and the value

of the related asset be increased by that amount. The

statement also requires that the liability be maintained at its

present value in subsequent periods and outlines certain

disclosures for such obligations. The adoption of this

statement, which is effective January 1, 2003, is not expected

to have a material impact on the Corporation’s consolidated

financial statements.

In October 2001, the FASB issued SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived

Assets,” which replaces SFAS No. 121. This statement

primarily defines one accounting model for long-lived assets

to be disposed of by sale, including discontinued operations,

and addresses implementation issues regarding the

impairment of long-lived assets. PNC adopted this standard

effective January 1, 2002. The standard is not expected to

have a material impact on the Corporation’s consolidated

financial statements.