PNC Bank 2001 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

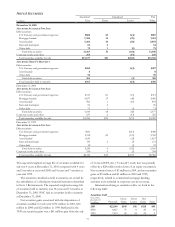

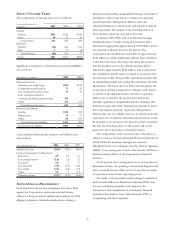

The following table sets forth regulatory capital ratios for

PNC and its only significant bank subsidiary, PNC Bank,

N.A.:

Regulatory Capital

Amount Ratios

December 31

Dollars in millions 2001 2000 2001 2000

Risk-based capital

Tier I

PNC $4,599 $5,367 7.8% 8.6%

PNC Bank, N.A. 4,704 5,055 8.7 8.7

Total

PNC 6,958 7,845 11.8 12.6

PNC Bank, N.A. 6,581 7,012 12.1 12.1

Leverage

PNC 4,599 5,367 6.8 8.0

PNC Bank, N.A. 4,704 5,055 7.6 8.2

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, deposit

insurance costs, and the level and nature of regulatory

oversight depend, in large part, on a financial institution’s

capital strength. The minimum regulatory capital ratios are

4% for Tier I risk-based, 8% for total risk-based and 3% for

leverage. However, regulators may require higher capital

levels when particular circumstances warrant. To qualify as

“well capitalized,” regulators require banks to maintain

capital ratios of at least 6% for Tier I risk-based, 10% for

total risk-based and 5% for leverage. At December 31, 2001,

the Corporation and each bank subsidiary met the “well

capitalized” capital ratio requirements.

The principal source of parent company revenue and

cash flow is the dividends it receives from PNC Bank. The

bank’s dividend level may be impacted by its capital needs,

supervisory policies, corporate policies, contractual

restrictions and other factors. Also, there are legal limitations

on the ability of national banks to pay dividends or make

other capital distributions. PNC Bank was not permitted to

pay dividends to the parent company as of December 31,

2001 without prior approval from banking regulators as a

result of the repositioning charges taken in 2001 and prior

dividends. Under these limitations, PNC Bank’s capacity to

pay dividends without prior regulatory approval can be

restored through retention of earnings. Management expects

PNC Bank’s dividend capacity relative to such legal

limitations to be restored during 2002 from retained

earnings. The parent company currently has available funds

to pay dividends at current rates through 2002.

Under federal law, bank subsidiaries generally may not

extend credit to the parent company or its nonbank

subsidiaries on terms and under circumstances that are not

substantially the same as comparable extensions of credit to

nonaffiliates. No extension of credit may be made to the

parent company or a nonbank subsidiary which is in excess

of 10% of the capital stock and surplus of such bank

subsidiary or in excess of 20% of the capital and surplus of

such bank subsidiary as to aggregate extensions of credit to

the parent company and its subsidiaries. Such extensions of

credit, with limited exceptions, must be fully collateralized by

certain specified assets. In certain circumstances, federal

regulatory authorities may impose more restrictive

limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal

Reserve Bank. During 2001, subsidiary banks maintained

reserves which averaged $127 million.

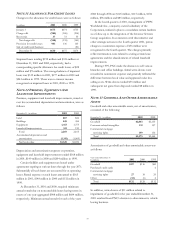

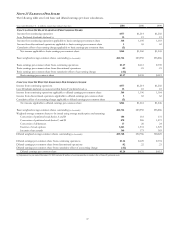

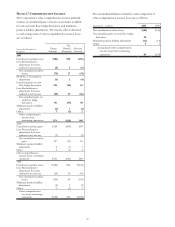

NOTE 20 FINANCIAL DERIVATIVES

Effective January 1, 2001, the Corporation implemented

SFAS No. 133. As a result of the adoption of this statement,

the Corporation recognized, in the first quarter of 2001, an

after-tax loss from the cumulative effect of a change in

accounting principle of $5 million reported in the

consolidated income statement and an after-tax accumulated

other comprehensive loss of $4 million. The impact of the

adoption of this standard related to the residential mortgage

banking business is reflected in the results of discontinued

operations.

Earnings adjustments resulting from cash flow and fair

value hedge ineffectiveness were not significant to the results

of operations of the Corporation during 2001.

During the next twelve months, the Corporation expects

to reclassify to earnings $118 million of pretax net gains, or

$77 million after tax, on cash flow hedge derivatives

currently reported in accumulated other comprehensive

income. These net gains are anticipated to result from net

cash flows on receive fixed interest rate swaps and would

mitigate reductions in interest income recognized on the

related floating rate commercial loans.

The Corporation generally has established agreements

with its major derivative dealer counterparties that provide

for exchanges of marketable securities or cash to collateralize

either party’s positions. At December 31, 2001 the

Corporation held cash and U.S. government securities with a

fair value of $190 million to collateralize net gains with

counterparties.

At December 31, 2000, the Corporation had financial

derivatives used for risk management with notional amounts

totaling $15.7 billion. These derivatives had a net positive fair