PNC Bank 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

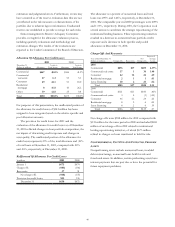

2000 VERSUS 1999

CONSOLIDATED INCOME STATEMENT REVIEW

Summary Results

Income from continuing operations for 2000 was $1.214

billion or $4.09 per diluted share compared with $1.202

billion or $3.94 per diluted share, respectively, for 1999.

Return on average common shareholders’ equity was 20.52%

and return on average assets was 1.76% for 2000 compared

with 21.29% and 1.76%, respectively, for 1999.

Net Interest Income

Taxable-equivalent net interest income of $2.182 billion for

2000 decreased $184 million or 8% compared with 1999. The

net interest margin of 3.64% for 2000 narrowed 22 basis

points from 3.86% in the prior year. These decreases were

primarily due to funding costs related to the ISG acquisition,

changes in balance sheet composition and a higher interest

rate environment in 2000.

Provision For Credit Losses

The provision for credit losses was $136 million for 2000

compared with $163 million for 1999. Net charge-offs were

$135 million or .27% of average loans for 2000 compared

with $161 million or .31%, respectively, for 1999. The

decrease in the provision was primarily due to the sale of the

credit card business in the first quarter of 1999, partially

offset by higher commercial loan net charge-offs in 2000.

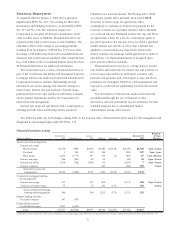

Noninterest Income

Noninterest income was $2.891 billion for 2000 and

represented 57% of total revenue compared with $2.450

billion and 51%, respectively, for 1999. The increase was

primarily driven by growth in certain fee-based businesses,

the benefit of the ISG acquisition and higher equity

management income.

Asset management fees of $809 million for 2000

increased $128 million or 19% primarily driven by new

business. Assets under management were $253 billion at

December 31, 2000, a 19% increase compared with

December 31, 1999. Fund servicing fees of $654 million for

2000 increased $403 million compared with 1999 primarily

due to the ISG acquisition. Excluding ISG, fund servicing

fees increased 22% mainly due to existing and new client

growth.

Service charges on deposits of $206 million for 2000

were consistent with the prior year. Brokerage fees of $249

million for 2000 increased $30 million or 14% compared

with 1999 reflecting expansion of Hilliard Lyons’ distribution

network. Consumer services revenue of $209 million for

2000 increased 7% compared with the prior year, excluding

credit card fees, primarily due to higher consumer

transaction volume.

Corporate services revenue was $342 million for 2000

compared with $133 million for 1999. The increase in

corporate services revenue was primarily driven by the

comparative impact of valuation adjustments in the prior

year and higher treasury management and commercial

mortgage servicing fees that were partially offset by a lower

level of commercial mortgage-backed securitization gains due

to the impact of weaker capital market conditions.

Equity management income was $133 million for 2000

compared to $100 million in the prior year.

Net securities gains were $20 million for 2000 compared

with $22 million for 1999. The net securities gains in 1999

included a $41 million gain from the sale of Concord EFS,

Inc. stock that was partially offset by a $28 million write-

down of an equity investment.

Sale of subsidiary stock of $64 million in 1999 reflected

the gain from the BlackRock initial public offering.

Other noninterest income was $269 million for 2000

compared with $555 million for 1999. The decrease resulted

primarily from the comparative impact of gains in 1999 from

the sale of the credit card business of $193 million and from

the sale of an equity interest in Electronic Payment Services,

Inc. of $97 million.

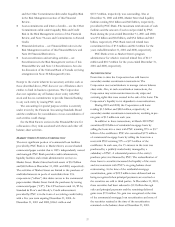

Noninterest Expense

Noninterest expense was $3.071 billion and the efficiency

ratio was 56.85% for 2000 compared with $2.843 billion and

55.54%, respectively, for 1999. The increases were primarily

related to the ISG acquisition. Average full-time equivalent

employees totaled approximately 24,100 and 22,700 for 2000

and 1999, respectively. The increase was primarily due to the

ISG acquisition, partially offset by the impact of efficiency

initiatives in traditional banking businesses and the sale of the

credit card business in 1999.