PNC Bank 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

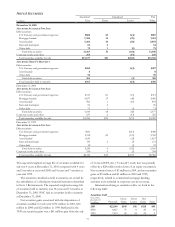

the effective-interest method, are included in interest

income. Gains and losses realized on the sale of securities

available for sale are computed on a specific security basis

and included in noninterest income.

LOANS AND LEASES

Loans are stated at the principal amounts outstanding, net of

unearned income. Interest income with respect to loans

other than nonaccrual loans is accrued on the principal

amount outstanding. Significant loan fees are deferred and

accreted to interest income over the respective lives of the

loans.

The Corporation also provides financing for various

types of equipment, aircraft, energy and power systems and

rolling stock through a variety of lease arrangements. Direct

financing leases are carried at the aggregate of lease payments

plus estimated residual value of the leased property, less

unearned income. Lease financing income is recognized over

the term of the lease using methods that approximate the

level yield method. Gains or losses on the sale of leased

assets or valuation adjustments on lease residuals are

included in noninterest income.

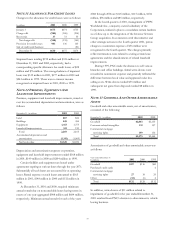

LOAN SECURITIZATIONS AND RETAINED INTERESTS

The Corporation sells mortgage and other loans through

secondary market securitizations. In certain cases, the

Corporation will retain a portion of the securities issued,

interest-only strips, one or more subordinated tranches,

servicing rights and/or cash reserve accounts, all of which

are associated with the securitized asset. Any gain or loss

recognized on the sale of the loans depends on the allocation

between the loans sold and the retained interests, based on

their relative fair market values at the date of transfer. The

Corporation generally estimates fair value based on the

present value of future expected cash flows using

assumptions as to discount rates, prepayment speeds, credit

losses and servicing costs, if applicable.

Servicing rights are maintained at the lower of carrying

value or fair market value and are amortized in proportion to

estimated net servicing income. Retained interests in loan

securitizations are carried at fair market value and included in

other assets. For retained interests classified as securities

available for sale, adjustments to fair market value are

recognized through accumulated other comprehensive

income or loss. Fair market value adjustments for all other

retained interests are recorded in noninterest income. For

servicing rights retained, the Corporation generally receives a

fee for servicing the securitized loans.

For purposes of measuring impairment, the Corporation

stratifies the pools of assets underlying servicing rights by

product type and geographic region of the borrower. A

valuation allowance is recorded when the carrying amount of

specific asset strata exceeds its fair value.

NONPERFORMING ASSETS

Nonperforming assets include nonaccrual loans, troubled

debt restructurings, nonaccrual loans held for sale and

foreclosed assets. Generally, loans other than consumer are

classified as nonaccrual when it is determined that the

collection of interest or principal is doubtful or when a

default of interest or principal has existed for 90 days or

more, unless the loans are well secured and in the process of

collection. When interest accrual is discontinued, accrued but

uncollected interest credited to income in the current year is

reversed and unpaid interest accrued in the prior year, if any,

is charged against the allowance for credit losses. Consumer

loans are generally charged off when payments are past due

120 days.

A loan is categorized as a troubled debt restructuring in

the year of restructuring if a significant concession is granted

to the borrower due to deterioration in the financial

condition of the borrower.

Nonperforming loans are generally not returned to

performing status until the obligation is brought current and

has performed in accordance with the contractual terms for a

reasonable period of time and collection of the contractual

principal and interest is no longer doubtful.

Impaired loans consist of nonaccrual commercial and

commercial real estate loans and troubled debt

restructurings. Interest collected on these loans is recognized

on the cash basis or cost recovery method.

Loans held for sale, which are carried at lower of cost or

market value, are considered nonaccrual when it is

determined that the collection of interest or principal is

doubtful or when a default of interest or principal has existed

for 90 days or more, unless the loans are well secured and in

the process of collection. Nonaccrual loans held for sale are

reported as other nonperforming assets.

Foreclosed assets are comprised of property acquired

through a foreclosure proceeding or acceptance of a deed-in-

lieu of foreclosure. These assets are recorded on the date

acquired at the lower of the related loan balance or market

value of the collateral less estimated disposition costs. Market

values are estimated primarily based on appraisals.

Subsequently, foreclosed assets are valued at the lower of the

amount recorded at acquisition date or the current market

value less estimated disposition costs. Gains or losses

realized from disposition of such property are reflected in

noninterest expense.