PNC Bank 2001 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

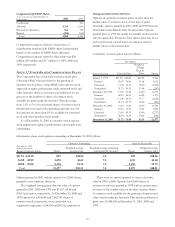

89

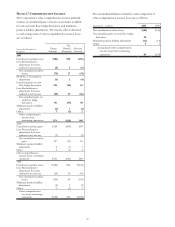

Results Of Businesses

Year ended December 31

In millions

Regional

Community

Banking

Corporate

Banking

PNC

Real Estate

Finance

PNC

Business

Credit

PNC

Advisors BlackRock PFPC Other Consolidated

2001

INCOME STATEMENT

Net interest income $1

,

460 $501 $116 $104 $128 $11 $

(

66

)

$8 $2

,

262

Noninterest income 758 32 89

(

8

)

607 533 726

(

194

)

2

,

543

T

otal revenue 2

,

218 533 205 96 735 544 660

(

186

)

4

,

805

Provision for credit losses 50 733 44 29 2 45 903

Depreciation and amortization 71 13 22 2 17 26 45 77 273

Other noninterest expense 1,169 374 136 29 487 337 554 (21) 3,065

Pretax earnings 928 (587) 3 36 229 181 61 (287) 564

Income taxes 332

(

212

)

(

35

)

14 86 74 25

(

97

)

187

Earnings $596 $(375) $38 $22 $143 $107 $36 $(190) $377

Inter-segment revenue $11 $4 $61 $16 $6 $(98)

AVERAGE ASSETS $40,285 $16,685 $5,290 $2,463 $3,330 $684 $1,771 $(153) $70,355

2000

I

NCOME

S

TATEMENT

Net interest income $1

,

408 $582 $118 $99 $136 $7 $

(

46

)

$

(

140

)

$2

,

164

Noninterest income 619 254 108 20 656 477 656 101 2

,

891

T

otal revenue 2

,

027 836 226 119 792 484 610

(

39

)

5

,

055

Provision for credit losses 45 79

(

7

)

12 5 2 136

Depreciation and amortization 71 13 20 2 14 20 49 70 259

Other noninterest expense 1,000 381 125 28 497 314 483 (16) 2,812

Pretax earnings 911 363 88 77 276 150 78 (95) 1,848

Income taxes 321 122 4 28 103 63 31

(

38

)

634

Earnings $590 $241 $84 $49 $173 $87 $47 $(57) $1,214

Inter-segment revenue $3 $5 $79 $13 $5 $(105)

AVERAGE ASSETS $38,958 $17,746 $5,889 $2,271 $3,500 $537 $1,578 $(1,988) $68,491

1999

I

NCOME

S

TATEMENT

Net interest income $1

,

411 $534 $132 $71 $130 $

(

8

)

$6 $68 $2

,

344

Noninterest income 667 85 67 11 608 381 251 380 2

,

450

T

otal revenue 2

,

078 619 199 82 738 373 257 448 4

,

794

Provision for credit losses 61 16 9 11 7 59 163

Depreciation and amortization 96 18 22 2 18 18 12 110 296

Other noninterest expense 1,002 381 118 23 483 252 175 113 2,547

Pretax earnings 919 204 50 46 230 103 70 166 1,788

Income taxes 326 59 17 88 44 26 26 586

Earnings $593 $145 $50 $29 $142 $59 $44 $140 $1,202

Inter-segment revenue $6 $2 $(1) $81 $10 $3 $(101)

AVERAGE ASSETS $37,502 $18,041 $7,133 $1,759 $3,353 $448 $308 $(630) $67,914

Gains on the sales of the credit card business, the

BlackRock IPO and Concord stock totaling $298 million in

1999 are included in the “Other” category. Also in 1999,

costs related to efficiency initiatives of $48 million and a

contribution to the PNC Foundation of $30 million are

included in the “Other” category.

Differences between management accounting practices

and generally accepted accounting principles, divested and

exited businesses, equity management activities, minority

interest in income of consolidated entities, residual asset

and liability management activities, eliminations and

unassigned items comprise the remainder of the “Other”

category.