PNC Bank 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

CREDIT-RELATED INSTRUMENTS

Credit default swaps provide, for a fee, an assumption of a

portion of the credit risk associated with the underlying

financial instruments. The Corporation primarily uses such

contracts to mitigate credit risk associated with commercial

lending activities. At December 31, 2001, credit default

swaps of $198 million in notional value were used by the

Corporation to hedge credit risk associated with commercial

lending activities.

INTEREST RATE RISK

Interest rate risk arises primarily through the Corporation’s

traditional business activities of extending loans and accepting

deposits. Many factors, including economic and financial

conditions, movements in interest rates and consumer

preferences affect the spread between interest earned on assets

and interest paid on liabilities. In managing interest rate risk,

the Corporation seeks to minimize its reliance on a particular

interest rate scenario as a source of earnings while

maximizing net interest income and net interest margin. To

further these objectives, the Corporation uses securities

purchases and sales, short-term and long-term funding,

financial derivatives and other capital markets instruments.

Interest rate risk is centrally managed by Asset and

Liability Management. The Corporation actively measures

and monitors components of interest rate risk including term

structure or repricing risk, yield curve or nonparallel rate

shift risk, basis risk and options risk. The Corporation

measures and manages both the short-term and long-term

effects of changing interest rates. An income simulation

model is designed to measure the sensitivity of net interest

income to changing interest rates over the next twenty-four

month period. An economic value of equity model is

designed to measure the sensitivity of the value of existing

on-balance-sheet and off-balance-sheet positions to changing

interest rates.

The income simulation model is the primary tool

used to measure the direction and magnitude of changes in

net interest income resulting from changes in interest rates.

Forecasting net interest income and its sensitivity to changes

in interest rates requires that the Corporation make

assumptions about the volume and characteristics of new

business and the behavior of existing positions. These

business assumptions are based on the Corporation’s

experience, business plans and published industry

experience. Key assumptions employed in the model include

prepayment speeds on mortgage-related assets and consumer

loans, loan volumes and pricing, deposit volumes and

pricing, the expected life and repricing characteristics of

nonmaturity loans and deposits, and management’s financial

and capital plans.

Because these assumptions are inherently uncertain, the

model cannot precisely estimate net interest income or

precisely predict the effect of higher or lower interest rates

on net interest income. Actual results will differ from

simulated results due to the timing, magnitude and frequency

of interest rate changes, the difference between actual

experience and the assumed volume and characteristics of

new business and behavior of existing positions, and changes

in market conditions and management strategies, among

other factors.

The Corporation models additional interest rate scenarios

covering a wider range of rate movements to identify yield

curve, term structure and basis risk exposures. These

scenarios are developed based on historical rate relationships

or management’s expectations regarding the future direction

and level of interest rates. Depending on market conditions

and other factors, these scenarios may be modeled more or

less frequently. Such analyses are used to identify risk and

develop strategies.

An economic value of equity model is used by the

Corporation to value all current on-balance-sheet and off-

balance-sheet positions under a range of instantaneous

interest rate changes. The resulting change in the value of

equity is a measure of overall long-term interest rate risk

inherent in the Corporation’s existing on-balance-sheet and

off-balance-sheet positions. The Corporation uses the

economic value of equity model to complement the net

interest income simulation modeling process.

The Corporation’s interest rate risk management policies

provide that net interest income should not decrease by

more than 3% if interest rates gradually increase or decrease

from current rates by 100 basis points over a twelve-month

period and that the economic value of equity should not

decline by more than 1.5% of the book value of assets for a

200 basis point instantaneous increase or decrease in interest

rates. Policy exceptions, if any, are reported to the Finance

Committee of the Board of Directors.

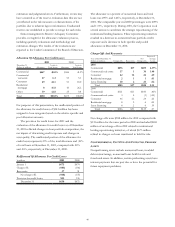

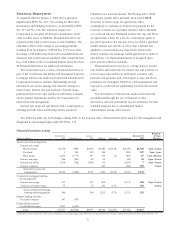

The following table sets forth the sensitivity results for

the last two years.