PNC Bank 2001 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

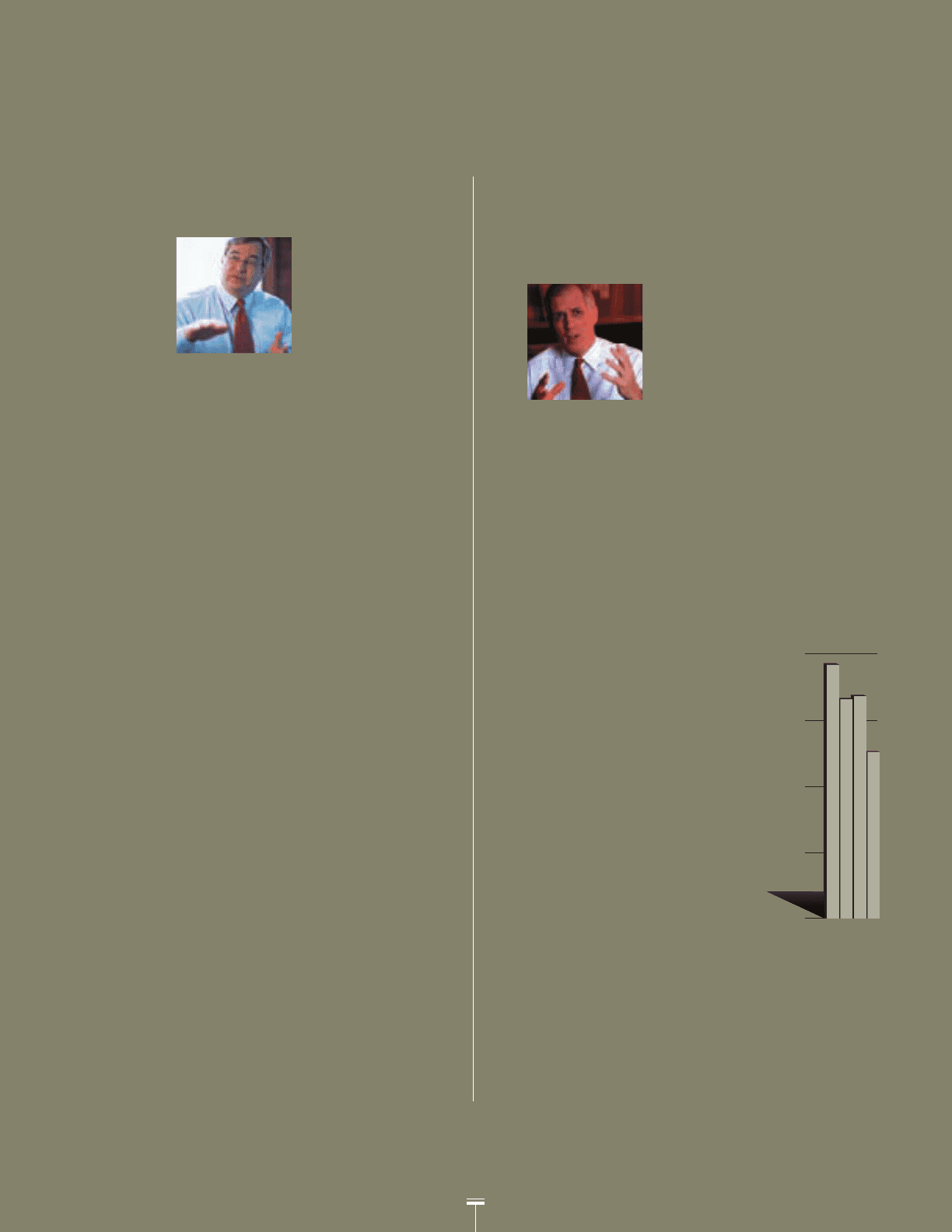

WHAT ARE YOUR KEY

PRIORITIES FOR 2002?

To put it simply

— execute

and grow.

We have

built a very

competitive and

powerful mix of businesses that

we believe is capable of achieving

higher-quality, capital-efficient

growth over time.

Now, we’re harnessing the

collective energies of our company

to deliver on the promise of these

businesses. We’re working to deepen

customer relationships and increase

our client base by strengthening our

sales culture. We also continue to

leverage our leading technology plat-

form to create additional products

and services to meet our customers’

growing needs.

Over the past three years,

our efforts have been focused on

reducing or eliminating higher-risk,

more capital-intensive activities.

As a result, we’re now concentrating

on the execution of our loan down-

sizing and asset quality.

Although we expect the business

environment to remain challenging,

I’m confident that we have a team of

24,000 employees deeply committed

to achieving these goals.

— Rohr

WHAT ARE YOU DOING

TO CREATE GREATER

VALUE IN PNC’S

BANKING BUSINESSES?

Over the past

three years,

we have

dramatically

reduced our

exposure to

certain large corporate credits, and

we have sold or downsized a number

of other lending businesses that

didn’t meet our goals for shareholder

return. As a result, as we execute

on our loan sales, we should have

a stronger group of banking

businesses that supports our goal

of delivering more consistent

earnings growth over time.

— Gregg

Our Regional Community Bank has

deepened its sales culture by building

a product set and distribution system

that’s helping to make things

simple for customers by anticipating

their needs and acting to identify

the right solution. This approach

helped drive an 11% growth in

average transaction deposits in

2001, and produced a higher-quality

revenue mix in this business.

8

Q&A

with Chairman Jim Rohr and Vice Chairman Walter Gregg

01

$38

00

$51

99

$50

0

15

30

45

60

98

$58

YEAR-END

LOANS

OUTSTANDING

(in billions)