PNC Bank 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

PFPC

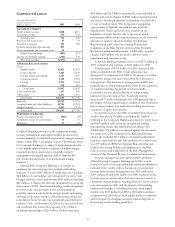

Year ended December 31

Dollars in millions 2001 2000

INCOME STATEMENT

Fund servicing revenue $738 $674

Operating expense 536 501

Amortization 25 31

Operating income 177 142

Nonoperating income (a) 14 31

Debt financing 94 95

Facilities consolidation

and other charges 36

Pretax earnings 61 78

Income taxes 25 31

Earnings $36 $47

AVERAGE BALANCE

S

HEET

Intangible assets $1,065 $1,107

Other assets 706 471

Total assets $1,771 $1,578

Assigned funds and other liabilities $1,563 $1,369

Assigned capital 208 209

Total funds $1,771 $1,578

P

ERFORMANCE

R

ATIO

S

Return on assigned capital 17% 22%

Operating margin 19 21

(a) Net of nonoperating expense

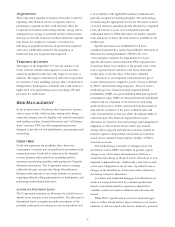

PFPC is the largest full-service mutual fund transfer agent

and second largest provider of mutual fund accounting and

administration services in the United States, providing a

wide range of fund services to the investment management

industry. PFPC also provides processing solutions to the

international marketplace through its Ireland and

Luxembourg operations.

To meet the growing needs of the European

marketplace, PFPC continues its pursuit of offshore

expansion. PFPC is also focusing technological resources

on targeted Web-based initiatives and exploring strategic

alliances.

In the fourth quarter of 2001, PFPC incurred $36

million of pretax charges largely related to a plan to

consolidate certain facilities as a follow-up to the

integration of the Investor Services Group (“ISG”)

acquisition. The charges primarily reflect termination costs

related to exiting certain lease agreements and the

abandonment of related leasehold improvements.

PFPC earned $36 million in 2001 compared with $47

million in 2000. Excluding facilities consolidation and

other charges in 2001, earnings increased $12 million or

26% in the year-to-year comparison and the return on

assigned capital and operating margin improved to 28%

and 24%, respectively. The increase was primarily due to

growth in transfer agency and subaccounting revenue that

resulted from an increase in shareholder accounts serviced,

and $9 million of nonrecurring fee adjustments.

Revenue of $738 million for 2001 increased $64 million

compared with 2000. An increase in shareholder accounts

serviced drove strong performance in transfer agency and

subaccounting revenues. The benefit of growth in

accounting/administration assets and shareholder accounts

more than offset the impact on revenue of lower custody

assets serviced. Revenue growth rates in this business may

be pressured by lower equity valuations, pricing and other

competitive factors. See Business and Economic

Conditions and Fund Servicing in the Risk Factors section

of this Financial Review for additional information

regarding matters that could impact fund servicing revenue.

Operating expense increased 7% in the year-to-year

comparison as the impact of business expansion was

partially mitigated by expense management initiatives and

the comparative impact of ISG integration costs that were

incurred in the prior year.

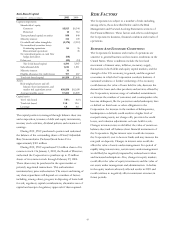

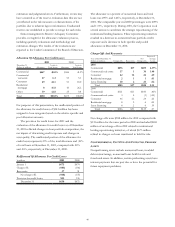

Servicing Statistics

December 31 2001 2000

Accounting/administration assets ($ in billions)

Domestic $514 $454

Foreign 21 9

Total $535 $463

Custody assets ($ in billions) 357 437

Shareholder accounts (in millions) 49 43