PNC Bank 2001 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

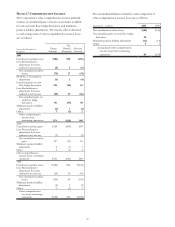

NOTE 31 PARENT COMPANY

Summarized financial information of the parent company is

as follows:

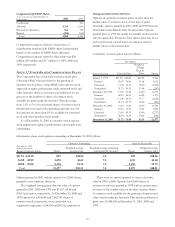

Statement Of Income

Year ended December 31 - in millions 2001 2000 1999

OPERATING REVENUE

Dividends from:

Bank subsidiaries $1,116 $690 $1,139

Nonbank subsidiaries 60 55 80

Interest income 699

Noninterest income 214

Total operating revenue 1,184 755 1,232

OPERATING

E

XPENS

E

Interest expense 50 54 86

Other expense 6(6) 52

Total operating expense 56 48 138

Income before income taxes and

equity in undistributed net

income of subsidiaries 1,128 707 1,094

Income tax benefits (17) (21) (47)

Income before equity in

undistributed net income of

subsidiaries 1,145 728 1,141

Bank subsidiaries (531) 386 (7)

Nonbank subsidiaries (237) 165 130

Net income $377 $1,279 $1,264

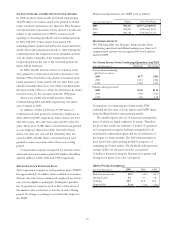

Balance Sheet

December 31 - in millions 2001 2000

ASSETS

Cash and due from banks $1 $1

Securities available for sale 94 53

Investments in:

Bank subsidiaries 5,324 5,640

Nonbank subsidiaries 1,555 1,656

Other assets 152 160

T

otal assets $7,126 $7,510

LIABILITIE

S

Borrowed funds $100

Nonbank affiliate borrowings $1,086 522

Accrued expenses and other liabilities 217 232

T

otal liabilities 1,303 854

S

HAREHOLDERS’

E

QUITY 5,823 6,656

Total liabilities and shareholders’ equity $7,126 $7,510

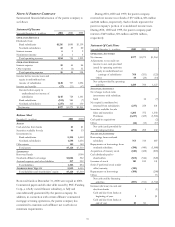

Borrowed funds at December 31, 2000 were repaid in 2001.

Commercial paper and all other debt issued by PNC Funding

Corp., a wholly owned finance subsidiary, is fully and

unconditionally guaranteed by the parent company. In

addition, in connection with certain affiliates’ commercial

mortgage servicing operations, the parent company has

committed to maintain such affiliates’ net worth above

minimum requirements.

During 2001, 2000 and 1999, the parent company

received net income tax refunds of $37 million, $36 million

and $44 million, respectively. Such refunds represent the

parent company’s portion of consolidated income taxes.

During 2001, 2000 and 1999, the parent company paid

interest of $49 million, $56 million and $96 million,

respectively.

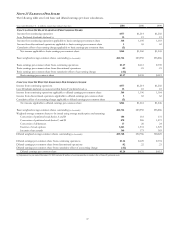

Statement Of Cash Flows

Year ended December 31 - in millions 2001 2000 1999

OPERATING ACTIVITIES

Net income $377 $1,279 $1,264

Adjustments to reconcile net

income to net cash provided

(used) by operating activities:

Equity in undistributed net

earnings of subsidiaries 768 (551) (123)

Other 44 (24) (14)

Net cash provided by operating

activities 1,189 704 1,127

INVESTING ACTIVITIES

Net change in short-term

investments with subsidiary

bank 16 (7)

Net capital (contributed to)

returned from subsidiaries (237) 258 631

Securities available for sale

Sales and maturities 1,206 372 1,592

Purchases (1,247) (425) (1,565)

Cash paid in acquisitions (2)

Other (14) (13) (17)

Net cash (used) provided by

investing activities (292) 208 632

FINANCING ACTIVITIES

Borrowings from nonbank

subsidiary 763 314 687

Repayments on borrowings from

nonbank subsidiary (190) (440) (1,080)

Acquisition of treasury stock (681) (428) (803)

Cash dividends paid to

shareholders (569) (546) (520)

Issuance of stock 181 189 141

Series F preferred stock tender

offer/maturity (301)

Repayments on borrowings (100) (200)

Other 15

Net cash used by financing

activities (897) (911) (1,760)

Increase (decrease) in cash and

due from banks 1 (1)

Cash and due from banks at

beginning of year 1$1

Cash and due from banks at

end of year $1 $1