PNC Bank 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

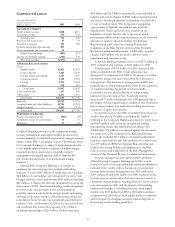

Securities represented 18% of average interest-earning assets

for 2001 compared with 10% for 2000. The increase was

primarily due to the retention of interests from the

securitization of residential mortgage loans and net securities

purchases upon redeployment of funds resulting from loan

downsizing and interest rate risk management activities.

Funding cost is affected by the volume and composition

of funding sources as well as related rates paid thereon.

Average deposits comprised 64% and 66% of total sources of

funds for 2001 and 2000, respectively, with the remainder

primarily comprised of wholesale funding obtained at

prevailing market rates.

Average interest-bearing demand and money market

deposits increased $2.6 billion or 14% compared with 2000,

primarily reflecting the impact of strategic marketing

initiatives to grow more valuable transaction accounts, while

all other interest-bearing deposit categories decreased in the

year-to-year comparison as management de-emphasized these

more costly sources of funds. Average borrowed funds for

2001 were essentially flat compared with 2000.

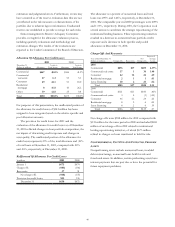

PROVISION FOR CREDIT LOSSES

The provision for credit losses was $903 million for 2001

compared with $136 million for 2000. The increase was

primarily related to provision expense of $714 million to

provide for net charge-offs associated with institutional

lending repositioning initiatives in 2001. As a result of these

charge-offs and other reserve activity in 2001, the allowance

for credit losses was $630 million at December 31, 2001

compared with $675 million at December 31, 2000. See Credit

Risk in the Risk Management section and Critical Accounting

Policies and Judgments in the Risk Factors section of this

Financial Review for additional information regarding credit

risk.

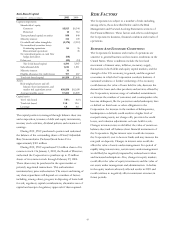

NONINTEREST INCOME

Noninterest income was $2.543 billion for 2001 compared

with $2.891 billion in 2000.

Asset management fees of $848 million for 2001 increased

$39 million or 5% primarily driven by new institutional

business and strong fixed-income performance at BlackRock

which more than offset decreases at PNC Advisors primarily

due to the impact of declining equity markets. Consolidated

assets under management were $284 billion at December 31,

2001, a 12% increase compared with December 31, 2000.

Fund servicing fees were $724 million for 2001, a $70 million

increase compared with 2000 primarily driven by new client

growth.

Service charges on deposits increased 6% to $218 million

for 2001 mainly due to an increase in transaction deposit

accounts. Brokerage fees were $206 million for 2001

compared with $249 million for 2000 as increased fees from

sales of insurance products were more than offset by declines

in other brokerage revenue due to weak equity markets.

Consumer services revenue of $229 million for 2001

increased $20 million or 10% compared with 2000 mainly

due to the expansion of PNC’s ATM network and the

increase in transaction deposit accounts.

Corporate services revenue was $60 million for 2001

compared with $342 million for 2000. Revenue in 2001 was

adversely impacted by valuation adjustments on loans held

for sale of $259 million. In addition, increases in treasury

management and CMBS servicing revenue were more than

offset by the comparative impact of losses resulting from

lower valuations of equity investments and lower capital

markets fees in 2001.

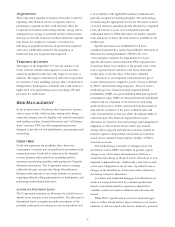

Equity management, which is comprised of venture

capital activities, reflected net losses of $179 million for 2001

compared with net gains of $133 million in 2000. The

decrease primarily resulted from a decline in the estimated

fair value of both limited partnership and direct investments.

At December 31, 2001, equity management investments held

by PNC and consolidated subsidiaries totaled approximately

$574 million. Approximately 53% of that amount is invested

directly in a variety of companies and 47% is invested in

various limited partnerships. The valuation of equity

management assets is subject to the performance of the

underlying companies as well as market conditions and may

be volatile. The Corporation’s strategy in equity management

is to attract funding from investors and generate a greater

proportion of revenues from fees earned by managing

investments for others. See Business and Economic

Conditions and Critical Accounting Policies and Judgments

in the Risk Factors section of this Financial Review for

additional information regarding equity management assets.

Net securities gains were $131 million for 2001 compared

with $20 million in 2000.

Other noninterest income was $306 million for 2001

compared with $269 million for 2000. Excluding $12 million

of asset write-downs in the fourth quarter of 2001, other

noninterest income increased 18% primarily due to higher

revenue from trading activities and gains on the sale of

residential mortgage loans. Net trading income included in

other noninterest income was $142 million in 2001 compared

with $84 million in 2000. See details in Note 7 Trading

Activities.