PNC Bank 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

BLACKROCK

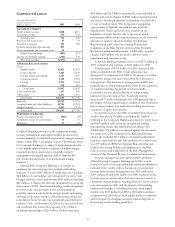

Year ended December 31

Dollars in millions 2001 2000

INCOME STATEMENT

Investment advisory and

administrative fees $495 $453

Other income 38 24

T

otal revenue 533 477

Operating expense 292 248

Fund administration

and servicing costs – affiliates 61 76

Amortization of intangible assets 10 10

Total expense 363 334

Operating income 170 143

Nonoperating income 11 7

Pretax earnings 181 150

Income taxes 74 63

Earnings $107 $87

P

ERIOD-

E

ND BALANCE

S

HEET

Intangible assets $182 $192

Other assets 502 345

Total assets $684 $537

Liabilities $198 $169

Stockholders’ equity 486 368

Total liabilities and

stockholders’ equity $684 $537

P

ERFORMANCE

D

ATA

Return on equity 25% 27%

Operating margin (a) 36 36

Diluted earnings per share $1.65 $1.35

(a) Excludes the impact of fund administration and servicing costs - affiliates.

BlackRock is one of the largest publicly traded investment

management firms in the United States with approximately

$239 billion of assets under management at December 31,

2001. BlackRock manages assets on behalf of institutions and

individuals worldwide through a variety of fixed income,

liquidity and equity mutual funds, separate accounts and

alternative investment products. Mutual funds include the

flagship fund families, BlackRock Funds and BlackRock

Provident Institutional Funds. In addition, BlackRock

provides risk management and investment system services to

institutional investors under the BlackRock Solutions name.

BlackRock continues to focus on delivering superior

investment performance to clients while pursuing strategies

to build on core strengths and to selectively expand the

firm’s expertise and breadth of distribution.

Earnings increased 23% in the year-to-year comparison

primarily due to a $35 billion or 17% increase in assets under

management. New client mandates and additional funding

from existing clients resulted in $31 billion or 90% of the

increase in assets under management.

Total revenue for 2001 increased $56 million or 12%

compared with 2000 primarily due to new institutional

liquidity and fixed-income business and strong sales of

BlackRock Solutions products. The increase in operating

expense in the year-to-year comparison supported revenue

growth and business expansion.

See Business and Economic Conditions and Asset

Management Performance in the Risk Factors section of this

Financial Review for additional information regarding

matters that could impact asset management revenue.

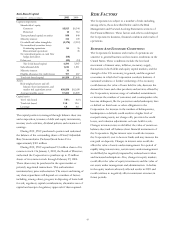

Assets Under Management

December 31 – in billions 2001 2000

Separate accounts

Fixed income $119 $104

Li

q

uidit

y

76

Li

q

uidity – securities lendin

g

11 12

E

q

uit

y

10 9

Alternative investment

p

roducts 53

T

otal se

p

arate accounts 152 134

Mutual funds (a)

Fixed income 16 13

Li

q

uidit

y

62 43

E

q

uit

y

914

T

otal mutual funds 87 70

T

otal assets under mana

g

emen

t

$239 $204

(a) Includes BlackRock Funds, BlackRock Provident Institutional Funds, BlackRock

Closed End Funds, Short Term Investment Funds and BlackRock Global Series

Funds.

BlackRock, Inc. is approximately 70% owned by PNC and is

listed on the New York Stock Exchange under the symbol

BLK. Additional information about BlackRock is available in

its filings with the Securities and Exchange Commission

(“SEC”) and may be obtained electronically at the SEC’s

home page at www.sec.gov.