PNC Bank 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

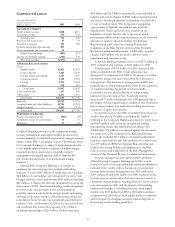

NONINTEREST EXPENSE

Noninterest expense was $3.338 billion for 2001 compared

with $3.071 billion for 2000. Costs to exit the vehicle leasing

business, including the impairment of goodwill associated

with a prior acquisition and employee severance costs, and

additions to reserves related to insured residual value

exposures totaled $135 million and are included in 2001

noninterest expense. In addition, $56 million of integration

and severance costs related to other strategic initiatives were

incurred in 2001. Excluding these items, noninterest expense

increased 2% compared with 2000. The increase was

primarily in businesses that have shown higher revenue

growth including Regional Community Banking, BlackRock

and PFPC. Average full-time equivalent employees totaled

approximately 24,500 and 24,100 for 2001 and 2000,

respectively. The increase was mainly in asset management

and processing businesses.

CONSOLIDATED BALANCE SHEET

REVIEW

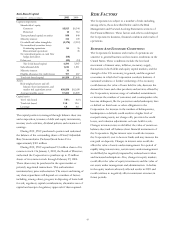

LOANS

Loans were $38.0 billion at December 31, 2001, a decrease of

$12.6 billion from year end 2000 primarily due to residential

mortgage securitizations and runoff, transfers to held for sale

and the managed reduction of institutional loans.

Details Of Loans

December 31 - in millions 2001 2000

Commercial

Manufacturing $3,352 $5,581

Retail/wholesale 3,856 4,413

Service providers 2,136 2,944

Real estate related 1,720 1,783

Financial services 1,362 1,726

Communications 139 1,296

Health care 517 722

Other 2,123 2,742

Total commercial 15,205 21,207

Commercial real estate

Mortgage 592 673

Real estate project 1,780 1,910

Total commercial real

estate 2,372 2,583

Consumer

Home equity 7,016 6,228

Automobile 773 1,166

Other 1,375 1,739

Total consumer 9,164 9,133

Residential mortgage 6,395 13,264

Lease financing 5,557 4,845

Other 445 568

Unearned income (1,164) (999)

Total, net of unearned income $37,974 $50,601

At December 31, 2001, loans of $38.0 billion included $1.9

billion of vehicle leases and $200 million of commercial loans

that have been designated for exit.

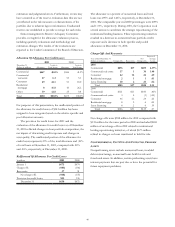

LOANS HELD FOR SALE

Loans held for sale were $4.2 billion at December 31, 2001

compared with $1.7 billion at December 31, 2000. In the

fourth quarter of 2001, PNC designated for exit $3.1 billion

of loans and $7.9 billion of institutional credit exposure. Of

these amounts, $2.3 billion, net of $.6 billion of related

charges, with total credit exposure of $4.6 billion were

transferred to loans held for sale. Approximately $276

million of loans held at December 31, 2001 by subsidiaries of

a third-party financial institution are classified in the

consolidated financial statements as loans held for sale.

Substantially all student loans are classified as loans held for

sale. See Note 14 Securitizations for information as to any

interests retained in these loans.

Details Of Loans Held For Sale

December 31 – in millions 2001 2000

Institutional lending repositioning $2,568 $286

Student loans 1,340 1,201

Other 281 168

Total loans held for sale $4,189 $1,655

See Strategic Repositioning and Critical Accounting Policies

and Judgments in the Risk Factors section of this Financial

Review for additional information regarding loans held for

sale.

SECURITIES

Total securities at December 31, 2001 were $13.9 billion

compared with $5.9 billion at December 31, 2000. Total

securities represented 20% of total assets at December 31,

2001 compared with 8% at December 31, 2000. The increase

was primarily due to purchases of mortgage-backed and

asset-backed securities during 2001 and the retention of

interests from the securitization of residential mortgage loans

as loans declined and were replaced with securities.

At December 31, 2001, the securities available for sale

balance included a net unrealized loss of $132 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2000 was a net

unrealized loss of $54 million. Net unrealized gains and losses

in the securities available for sale portfolio are included in

accumulated other comprehensive income or loss, net of tax or,

for the portion attributable to a hedged risk as part of a fair

value hedge strategy, in net income. The expected weighted-

average life of securities available for sale was 4 years at