PNC Bank 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

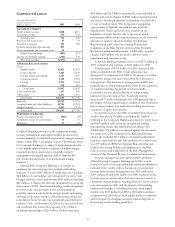

PNC BUSINESS CREDIT

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2001 2000

INCOME STATEMENT

Net interest income $104 $99

Noninterest income 30 20

Total revenue 134 119

Provision for credit losses 19 12

Noninterest expense 31 30

Institutional lending repositioning 48

Pretax earnings 36 77

Income taxes 14 28

Earnings $22 $49

AVERAGE BALANCE

S

HEET

Loans $2,331 $2,197

Loans held for sale 72 24

Other assets 60 50

Total assets $2,463 $2,271

Deposits $77 $66

Assigned funds and other liabilities 2,223 2,053

Assigned capital 163 152

Total funds $2,463 $2,271

P

ERFORMANCE

R

ATIO

S

Return on assigned capital 13% 32%

Efficiency 30 24

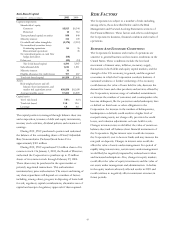

PNC Business Credit provides asset-based lending, capital

markets and treasury management products and services to

middle market customers nationally. PNC Business Credit’s

lending services include loans secured by accounts receivable,

inventory, machinery and equipment, and other collateral,

and its customers include manufacturing, wholesale,

distribution, retailing and service industry companies.

In January 2002, PNC Business Credit acquired a portion

of the U.S. asset-based lending business of NBOC. As a

result of this acquisition, PNC Business Credit established six

new marketing offices and enhanced its presence as one of

the premier asset-based lenders for the middle market

customer segment. At the acquisition date, credit exposure

acquired was approximately $2.6 billion including $1.5 billion

of loan outstandings. None of the loans were nonperforming

at acquisition.

Additionally, PNC Business Credit agreed to service a

portion of NBOC’s remaining U.S. asset-based loan

portfolio (“serviced portfolio”) for a period of eighteen

months. The serviced portfolio consisted of approximately

$670 million of credit exposure including $463 million of

outstandings as of the acquisition date. At closing, $138

million of these outstandings were classified as

nonperforming. The serviced portfolio’s credit exposure and

outstandings are expected to be reduced through managed

liquidation and runoff during the eighteen-month servicing

period. At the end of the servicing term, NBOC has the right

to transfer the then remaining serviced portfolio to PNC

Business Credit. PNC Business Credit established a liability

of $112 million in 2002 as part of the allocation of the

purchase price to reflect this obligation. The amount of this

liability will be assessed quarterly with any changes

recognized in earnings. During the servicing term, NBOC

will be responsible for realized credit losses with respect to

the serviced portfolio to a maximum of $50 million. If the

right to transfer is exercised, the Corporation is responsible

for realized credit losses on the serviced portfolio that may

occur during the eighteen-month period in excess of certain

NBOC specific reserves related to those assets, when

applicable (available only on specified credits), and the $50

million first loss position. PNC Business Credit management

currently expects the amounts indicated above to be

adequate to cover potential losses in connection with the

serviced portfolio.

During 2001, as part of the overall lending repositioning,

a total of $88 million of credit exposure including $78 million

of outstandings was designated for sale. At December 31,

2001, $40 million of credit exposure including $30 million of

outstandings was classified as held for sale, net of charges of

$48 million that represented the excess of principal balances

outstanding over the lower of cost or market values. See

Strategic Repositioning and Critical Accounting Policies and

Judgments in the Risk Factors section of this Financial

Review for additional information.

PNC Business Credit earnings were $22 million in 2001

compared with $49 million in 2000.

Revenue was $134 million for 2001, a $15 million or 13%

increase compared with 2000 primarily due to higher net

interest income, as a result of loan growth, and higher

noninterest income. The increase in noninterest income

primarily resulted from gains on sales of equity interests

received as compensation in conjunction with lending

relationships. Such gains, if any, are recognized infrequently

and may produce variability in revenues from period to

period.

Total credit costs in the 2001 consolidated provision for

credit losses were $29 million, including $19 million reflected

in the PNC Business Credit provision for credit losses and

$10 million reflected in the institutional lending repositioning

charge that represented net charge-offs. The institutional

lending repositioning charge also included $38 million of

valuation adjustments related to loans held for sale. The

provision for credit losses was $12 million in 2000. PNC

Business Credit loans are secured loans to borrowers, many

with a weaker credit risk rating. As a result, these loans

exhibit a higher risk of default. PNC Business Credit

attempts to mitigate this risk through higher interest rates,

direct control of cash flows, and collateral. The impact of

these loans on the provision for credit losses and the level of

nonperforming assets may be even more pronounced during

periods of economic downturn. See Critical Accounting

Policies and Judgments in the Risk Factors section and

Credit Risk in the Risk Management section of this Financial

Review for additional information.