Nokia 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

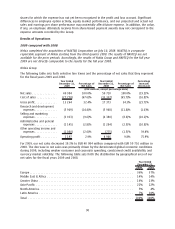

Results by Segments

Devices & Services

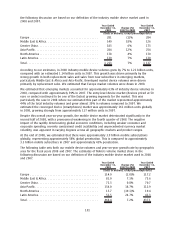

The following table sets forth our estimates for industry mobile device volumes and yearonyear

growth rate by geographic area for the fiscal years 2009 and 2008. These estimates and the following

discussion are based on our definition of the industry mobile device market used in 2009 and 2008.

Year Ended

December 31,

2009

(1)

Change

2008 to 2009

Year Ended

December 31,

2008

(Units in millions, except percentage data)

Europe .......................................... 252 (10)% 281

Middle East & Africa ................................ 137 (8)% 149

Greater China ..................................... 188 3% 183

AsiaPacific. . ..................................... 275 (3)% 284

North America .................................... 172 (3)% 178

Latin America..................................... 115 (17)% 139

Total ............................................ 1140 (6)% 1213

(1)

Beginning in 2010, we are revising our definition of the industry mobile device market that we

use to estimate industry volumes. This is due to improved measurement processes and tools that

enable us to have better visibility to estimate the number of mobile devices sold by certain new

entrants in the global mobile device market. These include vendors of legitimate, as well as

unlicensed and counterfeit, products with manufacturing facilities primarily centered around

certain locations in Asia and other emerging markets. For comparative purposes only going

forward, applying the revised definition and improved measurement processes and tools that we

are using beginning in 2010 retrospectively to 2009, we estimate that industry mobile device

volumes in 2009 would have been 1.26 billion units. We are not able to apply our revised

definition and improved measurement processes and tools retrospectively to our estimated

industry mobile device volumes in 2008 due to lack of visibility and data. The industry mobile

device volumes estimated for 2008 are not comparable with the industry mobile device volumes

estimates based on the revised definition.

According to our estimates, in 2009 industry mobile device volumes, based on the 2009 definition,

decreased by 6% to 1.14 billion units, compared with an estimated 1.21 billion units in 2008. The

global device market was negatively impacted in 2009 by the difficult global economic conditions,

including weaker consumer and corporate spending, constrained credit availability and currency

market volatility. The demand environment for mobile devices improved during the latter part of the

year as the global economy started to show initial signs of recovery.

We estimate that emerging markets accounted for approximately 63% of industry mobile device

volumes in 2009, based on the 2009 definition, unchanged from 2008. The devaluation of emerging

market currencies impacted the purchasing power of consumers in emerging markets, where Nokia’s

market share is strong. The entrylevel device market (devices priced at 50 euro or under) continued

to be one of the fastest growing segments for the market. This was particularly the case in 2009

where we estimate this part of the market represented approximately 48% of total industry volumes

compared to 44% in 2008. We estimate the converged mobile device market was approximately

176 million units globally in 2009, growing from approximately 161 million units in 2008, despite of

the decline in total industry mobile device volumes based on the 2009 definition.

At the end of 2009, we estimate that there were approximately 4.6 billion mobile subscriptions

globally, representing approximately 67% global penetration. This is compared to approximately

3.9 billion mobile subscribers at the end of 2008 and approximately 58% global penetration.

92