Nokia 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

Qualifying hedges are those properly documented hedges of the foreign exchange rate risk of foreign

currency denominated net investments that meet the requirements set out in IAS 39. The hedge must

be effective both prospectively and retrospectively.

The Group claims hedge accounting in respect of forward foreign exchange contracts, foreign currency

denominated loans, and options, or option strategies, which have zero net premium or a net

premium paid, and where the terms of the bought and sold options within a collar or zero premium

structure are the same.

For qualifying foreign exchange forwards, the change in fair value that reflects the change in spot

exchange rates is deferred in shareholders’ equity. The change in fair value that reflects the change in

forward exchange rates less the change in spot exchange rates is recognized in the profit and loss

account within financial income and expenses. For qualifying foreign exchange options the change in

intrinsic value is deferred in shareholders’ equity. Changes in the time value are at all times

recognized directly in the profit and loss account as financial income and expenses. If a foreign

currency denominated loan is used as a hedge, all foreign exchange gains and losses arising from the

transaction are recognized in shareholders’ equity. In all cases the ineffective portion is recognized

immediately in the income statement as financial income and expenses.

Accumulated fair value changes from qualifying hedges are released from shareholders’ equity into

the income statement only if the legal entity in the given country is sold, liquidated, repays its share

capital or is abandoned.

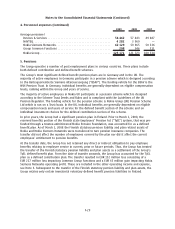

Income taxes

The tax expense comprises current tax and deferred tax. Current taxes are based on the results of the

Group companies and are calculated according to local tax rules. Taxes are recognized in the income

statement, except to the extent that it relates to items recognized in the other comprehensive income

or directly in equity, in which case the tax is recognized in other comprehensive income or equity,

respectively.

Deferred tax assets and liabilities are determined, using the liability method, for all temporary

differences arising between the tax bases of assets and liabilities and their carrying amounts in the

consolidated financial statements. Deferred tax assets are recognized to the extent that it is probable

that future taxable profit will be available against which the unused tax losses or deductible

temporary differences can be utilized. When circumstances indicate it is no longer probable that

deferred tax assets will be utilized they are assessed for realizability and adjusted as necessary.

Deferred tax liabilities are recognized for temporary differences that arise between the fair value and

tax base of identifiable net assets acquired in business combinations. Deferred tax assets and

deferred tax liabilities are offset for presentation purposes when there is a legally enforceable right to

set off current tax assets against current tax liabilities, and the deferred tax assets and the deferred

tax liabilities relate to income taxes levied by the same taxation authority on either the same taxable

entity or different taxable entities which intend either to settle current tax liabilities and assets on a

net basis, or to realize the assets and settle the liabilities simultaneously, in each future period in

which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.

The enacted or substantially enacted tax rates as of each balance sheet date that are expected to

apply in the period when the asset is realized or the liability is settled are used in the measurement

of deferred tax assets and liabilities.

F19

Notes to the Consolidated Financial Statements (Continued)