Nokia 2009 Annual Report Download - page 22

Download and view the complete annual report

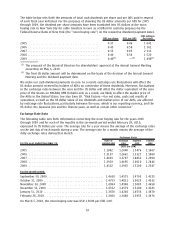

Please find page 22 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.business or any significant changes in the manner of our use of acquired assets or the strategy

for our overall business;

• cause lowered credit ratings of our short and longterm debt or their outlook from the credit

rating agencies and, consequently, impair our ability to raise new financing or refinance our

current borrowings and increase our interest costs associated with any new debt instruments;

• result in failures of derivative counterparties or other financial institutions which could have a

negative impact on our treasury operations;

• result in increased and/or more volatile taxes which could negatively impact our effective tax

rate; and

• impact our investment portfolio and other assets and result in impairment.

We currently believe our funding position to be sufficient to meet our operating and capital

expenditures in the foreseeable future. However, adverse developments in the global financial

markets could have a material adverse effect on our financial condition and results of operations. For

a more detailed discussion of our liquidity and capital resources, see Item 5B. “Liquidity and Capital

Resources” and Note 33 of our consolidated financial statements included in Item 18 of this annual

report.

Our business and results of operations, particularly our profitability, may be materially

adversely affected if we are not able to successfully manage costs related to our products and

services and their combinations, and to our operations.

We need to introduce costefficient products in a timely manner with new or enhanced functionalities

and services, manage proactively the costs related to our portfolio of products and services and their

combinations, manufacturing, logistics and other operations and mitigate adverse impacts of

exchange rate fluctuations related to such costs. If we fail in any of these efforts, this could have a

material adverse effect on our business and results of operations, particularly our profitability. We

believe that our market position in mobile devices provides economies of scale and, therefore, a cost

advantage in many areas of our business compared to our competitors. However, in certain areas of

our converged mobile device business, such as software development, applications and content, we

do not have a similar scale and cost benefit. Currency fluctuations may also have an adverse impact

on our ability to manage our costs and on our cost advantage relative to certain of our competitors

who incur a material part of their costs in other currencies than we do. If we fail to maintain or

improve our market position and scale compared to our competitors across the range of our products

and services, as well as leverage our scale to the fullest extent, or if we are unable to develop or

otherwise acquire software, applications and content cost competitively in comparison to our

competitors, or if our costs increase relative to those of our competitors due to currency fluctuations,

our relative cost advantage may be eroded, which could materially adversely affect our competitive

position, business and results of operations, particularly our profitability.

During 2009, we increased our costefficiency to adapt to the market situation. We need to continue

to manage our operating expenses and other costs to maintain cost efficiency and competitive pricing

of our products and services and their combinations. Any failure by us to determine the appropriate

prioritization of operating expenses and other costs, to identify and implement on a timely basis the

appropriate measures to adjust our operating expenses and other costs accordingly or to maintain

reductions could have a material adverse effect on our business, results of operations and financial

condition.

The products and services we offer are subject to natural price erosion over their life cycle. In

addition, the average selling price of our traditional mobile devices has declined during recent years

and it may continue to decline in the future. Factors that adversely impact the average selling price of

our mobile devices include the extent to which our customers and consumers do not upgrade their

mobile devices, postpone replacement or replace their current device with a lowerpriced device, and

20