Nokia 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

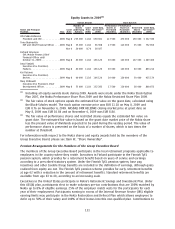

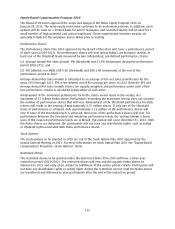

Summary Compensation Table 2009

Name and

Principal

Position

(1)

Year(**) Salary Bonus

(2)

Stock

Awards

(3)

Option

Awards

(3)

NonEquity

Incentive Plan

Compensation

Change in

Pension Value

and Nonqualified

Deferred

Compensation

Earnings

All Other

Compensation Total

EUR EUR EUR EUR EUR EUR EUR EUR

OlliPekka Kallasvuo 2009 1 176 000 1 288 144 3 332 940 650 661 (*) 1 358 429

(4)(5)

177 248

(6)

7 983 422

President and CEO . . . . . . . . . . . . 2008 1 144 800 721 733 2 470 858 548 153 (*) 469 060 175 164 5 529 768

2007 1 037 619 2 348 877 5 709 382 581 690 (*) 956 333 183 603 10 817 504

Timo Ihamuotila

EVP and Chief Financial Officer

(7)

. . . . 2009 396 825 234 286 752 856 135 834 (*) 15 575

(4)

21 195

(7)

1 556 571

Richard Simonson 2009 648 494 453 705 1 449 466 166 126 (*) 134 966

(9)

2 852 757

EVP, Mobile Phones (Chief Financial . . 2008 630 263 293 477 699 952 152 529 (*) 106 632 1 882 853

Officer until October 31, 2009)

(8)

2007 488 422 827 333 1 978 385 199 956 (*) 46 699 3 540 795

Anssi Vanjoki 2009 630 000 342 250 863 212 166 126 (*) 68 541

(4)

31 055

(10)

2 101 184

EVP, Markets . . . . . . . . . . . . . . . . 2008 615 143 260 314 699 952 152 529 (*) — 33 552 1 761 490

2007 556 381 900 499 1 978 385 199 956 (*) 18 521 49 244 3 702 986

Kai O

¨ista

¨mo

¨2009 460 000 343 225 935 174 166 126 (*) 9 824

(4)

29 778

(11)

1 944 127

EVP, Devices . . . . . . . . . . . . . . . . 2008 445 143 200 126 699 952 152 529 (*) 87 922 29 712 1 615 384

2007 382 667 605 520 1 978 385 199 956 (*) 41 465 32 086 3 240 079

Mary McDowell 2009 508 338 349 911 800 873 152 283 (*) 33 726

(12)

1 845 131

EVP, Chief Development Officer

(8)

. . . . 2008 493 798 196 138 620 690 133 463 (*) 33 462 1 477 551

2007 444 139 769 773 1 978 385 199 956 (*) 32 463 3 424 716

(1)

The positions set forth in this table are the current positions of the named executives. Until

October 30, 2009, Mr. Ihamuotila served as Executive Vice President and Global Head of Sales.

Mr. Simonson served as Executive Vice President and Chief Financial Officer until October 30,

2009.

(2)

Bonus payments are part of Nokia’s shortterm cash incentives. The amount consists of the

bonus awarded and paid or payable by Nokia for the respective fiscal year.

(3)

Amounts shown represent the grant date fair value of equity grants awarded in the respective

fiscal year. The fair value of stock options equals the estimated fair value on the grant date,

calculated using the BlackScholes model. The fair value of performance shares and restricted

shares equals the estimated fair value on grant date. The estimated fair value is based on the

grant date market price of the Nokia share less the present value of dividends expected to be

paid during the vesting period. The value of the performance shares is presented on the basis of

a number of shares, which is two times the number of shares at threshold. The value of

restricted shares and performance shares at maximum (four times the number of shares at

threshold), for each of the named executive officer, is as follows: Mr. Kallasvuo EUR 5 586 450;

Mr. Ihamuotila EUR 1 249 720; Mr. Simonson EUR 2 024 831; Mr. Vanjoki EUR 1 438 576; Mr.

O

¨ista

¨mo

¨EUR 1 510 538 and Ms. McDowell EUR 1 328 290.

(4)

The change in pension value represents the proportionate change in the liability related to the

individual executive. These executives are covered by the Finnish State employees’ pension act

(“TyEL”) that provides for a retirement benefit based on years of service and earnings according

to the prescribed statutory system. The TyEL system is a partly funded and a partly pooled “pay

as you go” system. Effective March 1, 2008, Nokia transferred its TyEL pension liability and assets

to an external Finnish insurance company and no longer carries the liability on its financial

statements. The figures shown represent only the change in liability for the funded portion. The

method used to derive the actuarial IFRS valuation is based upon available salary information at

the respective year end. Actuarial assumptions including salary increases and inflation have been

determined to arrive at the valuation at the respective year end.

(5)

The change in pension value for Mr. Kallasvuo includes the reduction of EUR 1 571 for the

proportionate change in the liability related to the individual under the funded part of the

Finnish TyEL pension (see footnote 4 above). In addition, it includes EUR 1 360 000 for the

129