Nokia 2009 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

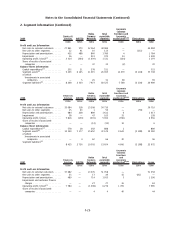

6. Other operating income and expenses (Continued)

operating profit and EUR 53 million in Nokia Siemens Networks’ operating profit. In addition, a gain

on business transfer EUR 53 million impacted Common functions’ operating profit. In 2007, other

operating expenses includes EUR 58 million in charges related to restructuring costs in Nokia Siemens

Networks. Devices & Services recorded a charge of EUR 17 million for personnel expenses and other

costs as a result of more focused R&D. Devices & Services also recorded restructuring costs of

EUR 35 million primarily related to restructuring of a subsidiary company.

In all three years presented, “Other operating income and expenses” include the costs of hedging

highly probable forecasted sales and purchases (forward points of cash flow hedges). As from 2009,

on the same line are included also the fair value changes of derivatives hedging identifiable and

probable forecasted cash flows.

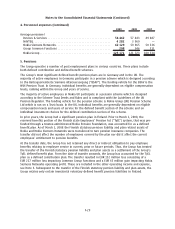

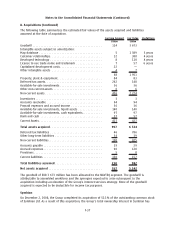

7. Impairment

2009 2008 2007

EURm EURm EURm

Capitalized development costs ....................................... — — 27

Goodwill ......................................................... 908 ——

Other intangible assets ............................................. 56 ——

Property, plant and equipment ....................................... 177 —

Inventories ....................................................... — 13 —

Investments in associated companies .................................. 19 87

Availableforsale investments ........................................ 25 43 29

Other noncurrent assets ............................................ — 8 —

Total, net ........................................................ 1 009 149 63

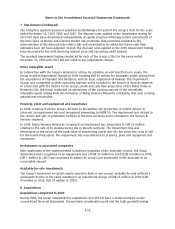

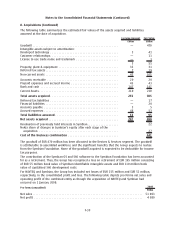

Capitalized development costs

In 2009 and 2008, the Group did not recognize any impairment charge on capitalized development

costs. During 2007, Nokia Siemens Networks recorded an impairment charge on capitalized

development costs of EUR 27 million. The impairment loss was determined as the full carrying

amount of the capitalized development programs costs related to products that will not be included

in future product portfolios. This impairment amount is included within research and development

expenses in the consolidated income statement.

Goodwill

Goodwill is allocated to the Group’s cashgenerating units (CGU) for the purpose of impairment

testing. The allocation is made to those cashgenerating units that are expected to benefit from the

synergies of the business combination in which the goodwill arose. The Group has allocated goodwill

to three cashgenerating units, which correspond to the Group’s operating and reportable segments:

Devices & Services CGU, Nokia Siemens Networks CGU and NAVTEQ CGU.

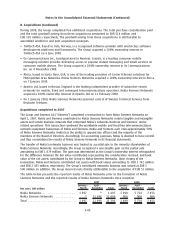

The recoverable amounts for the Devices & Services CGU and the NAVTEQ CGU are based on value in

use calculations. The cash flow projections employed in the value in use calculation are based on

financial plans approved by management. These projections are consistent with external sources of

information, wherever available. Cash flows beyond the explicit forecast period are extrapolated using

an estimated terminal growth rate that does not exceed the longterm average growth rates for the

industry and economies in which the CGU operates.

F33

Notes to the Consolidated Financial Statements (Continued)