Nokia 2009 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

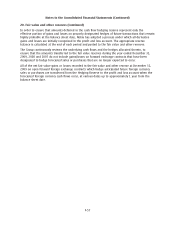

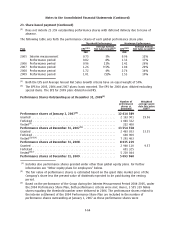

23. Sharebased payment (Continued)

outstanding until the final settlement in 2008. The final payout, in 2008, was adjusted by the

shares delivered based on the Interim Measurement Period.

(4)

Includes also performance shares vested under other than global equity plans.

(5)

Based on the performance of the Group during the Interim Measurement Period 20052006, under

the 2005 Performance Share Plan, both performance criteria were met. Hence, 3 980 572 Nokia

shares equaling the threshold number were delivered in 2007. The performance shares related to

the interim settlement of the 2005 Performance Share Plan are included in the number of

performance shares outstanding at December 31, 2007 as these performance shares were

outstanding until the final settlement in 2009. The final payout, in 2009, was adjusted by the

shares delivered based on the Interim Measurement Period.

(6)

Includes performance shares under Performance Share Plan 2006 that vested on December 31,

2008.

(7)

Includes performance shares under Performance Share Plan 2007 that vested on December 31,

2009.

There will be no settlement under the Performance Share Plan 2007 as neither of the threshold

performance criteria of EPS and Average Annual Net Sales Growth of this plan was met.

Restricted shares

The Group has granted restricted shares under global plans to recruit, retain, reward and motivate

selected high potential employees, who are critical to the future success of Nokia. It is Nokia’s

philosophy that restricted shares will be used only for key management positions and other critical

talent. The outstanding global restricted share plans, including their terms and conditions, have been

approved by the Board of Directors. A valid authorization from the Annual General Meeting is required

when the plans are to be settled by using Nokia newly issued shares or treasury shares. The Group

may also settle the plans by using cash instead of shares.

All of our restricted share plans have a restriction period of three years after grant, after which period

the granted shares will vest. Once the shares vest, they will be delivered to the participants. Until the

Nokia shares are delivered, the participants will not have any shareholder rights, such as voting or

dividend rights, associated with the restricted shares.

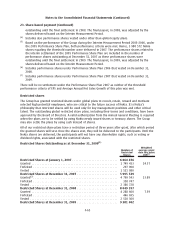

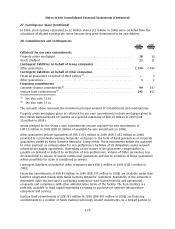

Restricted Shares Outstanding as at December 31, 2009

(1)

Number of

Restricted

Shares

Weighted

average grant

date fair value

EUR

(2)

Restricted Shares at January 1, 2007 ............................ 6 064 876

Granted ..................................................... 1749433 24.37

Forfeited .................................................... 297900

Vested ...................................................... 1521080

Restricted Shares at December 31, 2007 ......................... 5 995 329

Granted

(3)

.................................................... 4799543 13.89

Forfeited .................................................... 358747

Vested ...................................................... 2386728

Restricted Shares at December 31, 2008 ......................... 8 049 397

Granted ..................................................... 4288600 7.59

Forfeited .................................................... 446695

Vested ...................................................... 2510300

Restricted Shares at December 31, 2009 ......................... 9 381 002

F65

Notes to the Consolidated Financial Statements (Continued)