Nokia 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•

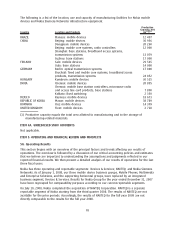

Manufacturing and logistics:

We enjoy a worldclass manufacturing and logistics system, which

is designed to deliver quality hardware and respond quickly to customer demand. During 2009,

we made over one million devices per day in our nine main device manufacturing facilities

globally.

•

Strategic sourcing and partnering:

We source components from a global network of strategic

partners, and we partner with leading companies for software, applications and content. We

focus our partnering efforts on the creation of differentiated solutions which we believe

influence consumer purchasing decisions. We also partner with operators offering them

opportunities to profit by promoting services adoption with us.

•

Distribution:

Nokia has the industry’s largest distribution network with over 650 000 points of

sale globally. Compared to our competitors, we have a substantially larger distribution and

care network, particularly in China, India and Middle East and Africa.

•

R&D and Software Platforms:

We invest significantly in research and development to

continuously develop and renew our portfolio of products and services and their combinations

to enable us to effectively target all major consumer segments and prices points, while

meeting the local requirements and preferences of our customers and consumers in the

different markets we serve, on a short, medium and longterm basis. To support the continued

enrichment and development of the user experience in our mobile devices we have invested

significantly in our software platforms: Series 30, Series 40, Symbian and Maemo, which is

being combined with Intel’s Moblin platform to create a new software platform called MeeGo.

These software assets are designed to balance usability, features and cost in a flexible manner

across our wide range of market segments, price points and user groups. We have also

developed crossplatform software development tools that run and facilitate application and

content development across different software platforms.

•

Intellectual Property:

Success in our industry requires significant research and development

investments, with intellectual property rights filed to protect those investments and related

inventions. We believe that Nokia has built one of the strongest and broadest patent portfolios

in the industry. Since the early 1990s, we have invested approximately EUR 40 billion

cumulatively in research and development, and we now own approximately 11 000 patent

families.

We have built these competitive advantages through years of investment and intend to continue to

invest, as appropriate, to maintain and enhance them. In the traditional mobile device market, we

believe it is difficult to deliver sustainable earnings growth without all of these capabilities. In the

converged mobile device market, while these capabilities continue to be relevant, net sales and

profitability are driven by other, additional capabilities. Innovations that significantly improve the

user experience are a key competitive factor in the converged mobile device market, and, as discussed

below, we expect to deliver improvements to our user experience in 2010. We are also focused on

building additional competitive advantages in the converged mobile device market by, for example,

establishing an ecosystem of consumers, application developers and content providers, operators and

other industry partners around our devices and services offerings. This effort to create a mutually

beneficial ecosystem is also relevant for our mobile phones category.

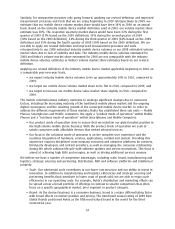

A key nonfinancial metric we use to measure our progress in creating new competitive advantages is

the number of active users of our services. We began using active users as an operational metric in

mid2009. It is a way to measure our progress as we develop and market new products and services

and their combinations designed to acquire, retain and deepen our relationship with consumers. In

the fourth quarter of 2009, our active users grew to 89 million, and we exceeded our second half

2009 target of 80 million. In January 2010, we implemented updated measurement tools to account

for user activity and contactability and, consequently, we revised our active user definition. Applying

the revised definition for comparative purposes only, our active users at the end of 2009 would have

68