Nokia 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

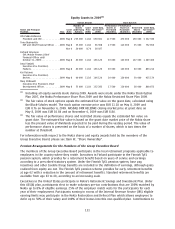

Equity Grants in 2009

(1)

Name and Principal

Position Year

Grant

Date

Number of

Shares

underlying

Options

Grant

Price

(EUR)

Grant Date

Fair Value

(2)

(EUR)

Performance

Shares at

Threshold

(Number)

Performance

Shares at

Maximum

(Number)

Restricted

Shares

(Number)

Grant Date

Fair Value

(3)

(EUR)

Option Awards Stock Awards

OlliPekka Kallasvuo

President and CEO............ 2009 May 8 235 000 11.18 650 661 117 500 470 000 150 000 3 332 940

Timo Ihamuotila

EVP and Chief Financial Officer . . . 2009 May 8 35 000 11.18 96 908 27 500 110 000 35 000 752 856

Nov 6 20 000 8.76 38 927

Richard Simonson

EVP, Mobile Phones (Chief

Financial Officer until

October 31, 2009) ............ 2009 May 8 60 000 11.18 166 126 30 000 120 000 107 000 1 449 466

Anssi Vanjoki

Executive Vice President,

Markets . .................. 2009 May 8 60 000 11.18 166 126 30 000 120 000 40 000 863 212

Kai O

¨ista

¨mo

¨

Executive Vice President,

Devices . .................. 2009 May 8 60 000 11.18 166 126 30 000 120 000 50 000 935 174

Mary McDowell

Executive Vice President, Chief

Development Officer . . ........ 2009 May 8 55 000 11.18 152 283 27 500 110 000 38 000 800 873

(1)

Including all equity awards made during 2009. Awards were made under the Nokia Stock Option

Plan 2007, the Nokia Performance Share Plan 2009 and the Nokia Restricted Share Plan 2009.

(2)

The fair value of stock options equals the estimated fair value on the grant date, calculated using

the BlackScholes model. The stock option exercise price was EUR 11.18 on May 8, 2009 and

EUR 8.76 on November 6, 2009. NASDAQ OMX HELSINKI closing market price at grant date on

May 8, 2009 was EUR 10.84 and on November 6, 2009 was EUR 8.84.

(3)

The fair value of performance shares and restricted shares equals the estimated fair value on

grant date. The estimated fair value is based on the grant date market price of the Nokia share

less the present value of dividends expected to be paid during the vesting period. The value of

performance shares is presented on the basis of a number of shares, which is two times the

number at threshold.

For information with respect to the Nokia shares and equity awards held by the members of the

Group Executive Board, please see Item 6E. “Share Ownership”.

Pension Arrangements for the Members of the Group Executive Board

The members of the Group Executive Board participate in the local retirement programs applicable to

employees in the country where they reside. Executives in Finland participate in the Finnish TyEL

pension system, which provides for a retirement benefit based on years of service and earnings

according to a prescribed statutory system. Under the Finnish TyEL pension system, base pay,

incentives and other taxable fringe benefits are included in the definition of earnings, although gains

realized from equity are not. The Finnish TyEL pension scheme provides for early retirement benefits

at age 62 with a reduction in the amount of retirement benefits. Standard retirement benefits are

available from age 63 to 68, according to an increasing scale.

Executives in the United States participate in Nokia’s Retirement Savings and Investment Plan. Under

this 401(k) plan, participants elect to make voluntary pretax contributions that are 100% matched by

Nokia up to 8% of eligible earnings. 25% of the employer match vests for the participants for each

year of their employment. Participants earning in excess of the Internal Revenue Service (IRS) eligible

earning limits may participate in the Nokia Restoration and Deferral Plan which allows employees to

defer up to 50% of their salary and 100% of their bonus into this nonqualified plan. Contributions to

131