Nokia 2009 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

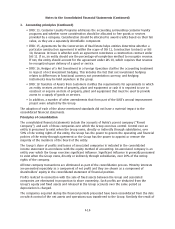

1. Accounting principles (Continued)

to regular and thorough review as to their collectability and as to available collateral; in the event

that any loan is deemed not fully recoverable, a provision is made to reflect the shortfall between the

carrying amount and the present value of the expected cash flows. Interest income on loans

receivable is recognized by applying the effective interest rate. The long term portion of loans

receivable is included on the statement of financial position under longterm loans receivable and the

current portion under current portion of longterm loans receivable.

Bank and cash

Bank and cash consist of cash at bank and in hand.

Accounts receivable

Accounts receivable are carried at the original amount due from customers, which is considered to be

fair value, less allowances for doubtful accounts based on a periodic review of all outstanding

amounts including an analysis of historical bad debt, customer concentrations, customer

creditworthiness, current economic trends and changes in our customer payment terms. Bad debts

are written off when identified as uncollectible, and are included within other operating expenses.

Financial liabilities

Loans payable

Loans payable are recognized initially at fair value, net of transaction costs incurred. Any difference

between the fair value and the proceeds received is recognized in profit and loss at initial

recognition. In the subsequent periods, they are stated at amortized cost using the effective interest

method. The long term portion of loans payable is included on the statement of financial position

under longterm interestbearing liabilities and the current portion under current portion of longterm

loans.

Accounts payable

Accounts payable are carried at the original invoiced amount, which is considered to be fair value due

to the shortterm nature.

Derivative financial instruments

All derivatives are initially recognized at fair value on the date a derivative contract is entered into

and are subsequently remeasured at their fair value. The method of recognizing the resulting gain or

loss varies according to whether the derivatives are designated and qualify under hedge accounting

or not. Generally the cash flows of a hedge are classified as cash flows from operating activities in the

consolidated statement of cash flows as the underlying hedged items relate to company’s operating

activities. When a derivative contract is accounted for as a hedge of an identifiable position relating

to financing or investing activities, the cash flows of the contract are classified in the same manner as

the cash flows of the position being hedged.

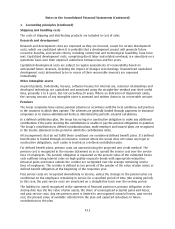

Derivatives not designated in hedge accounting relationships carried at fair value through profit and

loss

Fair values of forward rate agreements, interest rate options, futures contracts and exchange traded

options are calculated based on quoted market rates at each balance sheet date. Discounted cash

flow analyses are used to value interest rate and currency swaps. Changes in the fair value of these

contracts are recognized in the income statement.

F16

Notes to the Consolidated Financial Statements (Continued)