Nokia 2009 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

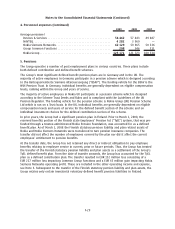

Dividends

Dividends proposed by the Board of Directors are not recorded in the financial statements until they

have been approved by the shareholders at the Annual General Meeting.

Earnings per share

The Group calculates both basic and diluted earnings per share. Basic earnings per share is computed

using the weighted average number of shares outstanding during the period. Diluted earnings per

share is computed using the weighted average number of shares outstanding during the period plus

the dilutive effect of stock options, restricted shares and performance shares outstanding during the

period.

Use of estimates and critical accounting judgements

The preparation of financial statements in conformity with IFRS requires the application of judgment

by management in selecting appropriate assumptions for calculating financial estimates, which

inherently contain some degree of uncertainty. Management bases its estimates on historical

experience and various other assumptions that are believed to be reasonable under the

circumstances, the results of which form the basis for making judgments about the reported carrying

values of assets and liabilities and the reported amounts of revenues and expenses that may not be

readily apparent from other sources. Actual results may differ from these estimates under different

assumptions or conditions.

Set forth below are areas requiring significant judgment and estimation that may have an impact on

reported results and the financial position.

Revenue recognition

Sales from the majority of the Group are recognized when the significant risks and rewards of

ownership have transferred to the buyer, continuing managerial involvement usually associated with

ownership and effective control have ceased, the amount of revenue can be measured reliably, it is

probable that economic benefits associated with the transaction will flow to the Group and the costs

incurred or to be incurred in respect of the transaction can be measured reliably. Sales may materially

change if management’s assessment of such criteria was determined to be inaccurate. The Group

enters into transactions involving multiple components consisting of any combination of hardware,

services and software. The consideration received from these transactions is allocated to each

separately identifiable component based on the relative fair value of each component. The

consideration allocated to each component is recognized as revenue when the revenue recognition

criteria for that component have been met. Determination of the fair value for each component

requires the use of estimates and judgment taking into consideration factors such as the price when

the component is sold separately by the Group or the price when a similar component is sold

separately by the Group or a third party, which may have a significant impact on the timing and

amount of revenue recognition.

The Group makes price protection adjustments based on estimates of future price reductions and

certain agreed customer inventories at the date of the price adjustment. Possible changes in these

estimates could result in revisions to the sales in future periods.

Revenue from contracts involving solutions achieved through modification of complex

telecommunications equipment is recognized on the percentage of completion basis when the

outcome of the contract can be estimated reliably. Recognized revenues and profits are subject to

revisions during the project in the event that the assumptions regarding the overall project outcome

are revised. Current sales and profit estimates for projects may materially change due to the early

F21

Notes to the Consolidated Financial Statements (Continued)