Nokia 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

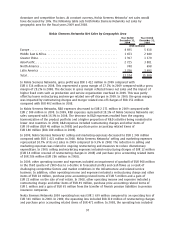

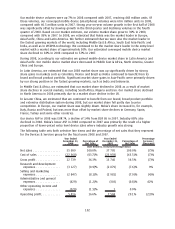

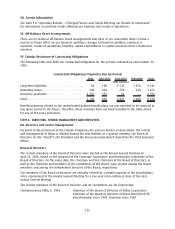

NAVTEQ net sales for the period from July 10, 2008 to December 31, 2008 were EUR 361 million. Net

sales were driven by the licensing of NAVTEQ’s geographic database and related locationbased

content. The following table sets forth NAVTEQ net sales by geographic area for the period from

July 10, 2008 to December 31, 2008.

From July 10 to

December 31,

2008

(EUR millions)

Europe ................................................................. 158

Middle East & Africa ...................................................... 29

China .................................................................. 2

AsiaPacific ............................................................. 10

North America ........................................................... 155

Latin America ........................................................... 7

Total................................................................... 361

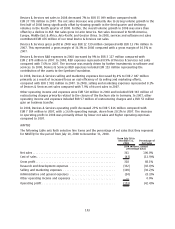

For the period from July 10, 2008 to December 31, 2008, NAVTEQ gross profit was EUR 318 million.

Gross profit reflects net sales, partially offset by costs related to the delivery of NAVTEQ’s database

information to its customers.

NAVTEQ R&D expenses for the period from July 10, 2008 to December 31, 2008 were EUR 332 million.

NAVTEQ R&D expenses included amortization of intangible assets recorded as part of Nokia’s

acquisition of NAVTEQ totaling EUR 171 million. R&D expenses were also driven by increased

investment in NAVTEQ’s map database related to geographic expansion and quality improvements.

R&D expenses represented 92.0% of NAVTEQ net sales for this period.

For the period from July 10, 2008 to December 31, 2008, NAVTEQ’s selling and marketing expenses

were EUR 109 million. NAVTEQ’s selling and marketing expenses primarily consisted of amortization of

intangible assets recorded as part of Nokia’s acquisition of NAVTEQ totaling EUR 57 million. Selling

and marketing expenses were also driven by investments to grow NAVTEQ’s worldwide sales force

and expand the breadth of its product offerings. Selling and marketing expenses represented 30.2%

of NAVTEQ net sales for this period.

NAVTEQ operating loss was EUR 153 million for the period from July 10, 2008 to December 31, 2008,

with an operating margin of negative 42.4%. The operating loss was primarily the result of the

amortization of intangible assets recorded as part of Nokia’s acquisition of NAVTEQ, which was

partially offset by profits from NAVTEQ’s ongoing business.

Nokia Siemens Networks

According to our estimates, the mobile infrastructure market was flat in euro terms in 2008 compared

to 2007 with the trend varying, depending on region. Slowed growth in developed markets was due

to decreasing investments in mature 2G networks which were not fully offset by the capacity

expansions of 3G networks. The mobile infrastructure market still grew in emerging markets such as

Middle East & Africa, Latin America and China due to the continued subscriber growth, resulting in

traffic and correlating capacity increases as well as new network buildouts. Globally, the volume

growth in the networks infrastructure equipment was significantly offset by the price erosion of the

equipment, largely as a result of maturing technologies and intense price competition. The fixed

infrastructure market continued to be characterized by intense price competition in 2008, both in

terms of the equipment price erosion due to heavy competition, especially from Asian vendors, and

declining tariffs.

104