Nokia 2009 Annual Report Download - page 109

Download and view the complete annual report

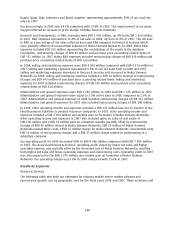

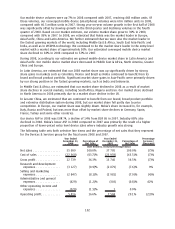

Please find page 109 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of certain tax benefits from prior years. In 2007, taxes include the positive impact of EUR 122 million

due to changes in deferred tax assets resulting from the decrease in the German statutory tax rate.

The effective tax rate increased to 21.8% in 2008 compared with 18.4% in 2007, primarily due to the

EUR 1 879 million nontaxable gain on formation of Nokia Siemens Networks in 2007.

Minority Interests

Minority shareholders’ interest in our subsidiaries’ losses totaled EUR 99 million in 2008 compared

with minority shareholders’ interest in our subsidiaries’ losses of EUR 459 million in 2007. The change

was primarily due to the decrease in the net losses of Nokia Siemens Networks.

Net Profit and Earnings per Share

Net profit in 2008 totaled EUR 3 988 million compared with EUR 7 205 million in 2007, representing a

yearonyear decrease in net profit of 44.6% in 2008. Earnings per share in 2008 decreased to

EUR 1.07 (basic) and EUR 1.05 (diluted) compared with EUR 1.85 (basic) and EUR 1.83 (diluted) in

2007.

Related Party Transactions

There have been no material transactions during the last three fiscal years to which any director,

executive officer or at least 5% shareholder, or any relative or spouse of any of them, was party.

There is no significant outstanding indebtedness owed to Nokia by any director, executive officer or

at least 5% shareholder.

There are no material transactions with enterprises controlling, controlled by or under common

control with Nokia or associates of Nokia.

See Note 30 to our consolidated financial statements included in Item 18 of this annual report.

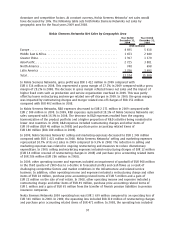

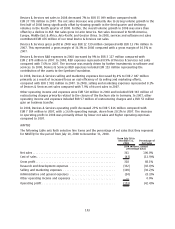

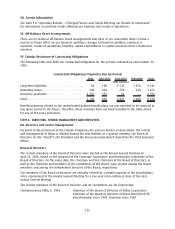

5B. Liquidity and Capital Resources

At December 31, 2009, our cash and other liquid assets (bank and cash; availableforsale

investments, cash equivalents; availableforsale investments, liquid assets; and investments at fair

value through profit and loss, liquid assets) increased to EUR 8 873 million, compared with

EUR 6 820 million at December 31, 2008, primarily as a result of a decline in cash used in investing

activities and cash used in financing activities. At December 31, 2007, cash and other liquid assets

totaled EUR 11 753 million.

Cash and cash equivalents (bank and cash and availableforsale investments, cash equivalent)

increased to EUR 5 926 million compared with EUR 5 548 million at December 31, 2008. We hold our

cash and cash equivalents predominantly in euro. Cash and cash equivalents totaled EUR 6 850 million

at December 31, 2007.

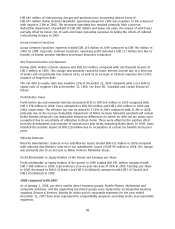

Net cash from operating activities was EUR 3 247 million in 2009 compared with EUR 3 197 million in

2008, and EUR 7 882 million in 2007. In 2009, net cash from operating activities increased primarily

due to a decrease in net working capital and a decrease in income taxes paid which were partially

offset by decreased profitability. In 2008, net cash from operating activities decreased primarily due

to decreased profitability, an increase in net working capital, Qualcomm lumpsum cash payment and

an increase in income taxes paid.

Net cash used in investing activities was EUR 2 148 million in 2009 compared with EUR 2 905 million

in 2008, and net cash from investing activities of EUR 710 million in 2007. Net cash used in

acquisitions of group companies, net of acquired cash, was EUR 29 million in 2009 compared with

EUR 5 962 million in 2008, due to the acquisition of NAVTEQ, and EUR 253 million of net cash from

acquisitions of group companies due to acquired cash in an otherwise noncash transaction in 2007.

Cash flow from investing activities in 2009 included purchases of current availableforsale

investments, liquid assets of EUR 2 800 million, compared with EUR 669 million in 2008 and

107