Nokia 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Similarly, for comparative purposes only going forward, applying our revised definition and improved

measurement processes and tools that we are using beginning in 2010 retrospectively to 2009, we

estimate that our mobile device volume market share would have been 34% in 2009 on an annual

basis. Based on the industry mobile device market definition used in 2009, our volume market share

estimate was 38%. The respective quarterly market shares would have been 32% during the first

quarter of 2009 (37% based on the 2009 definition), 35% during the second quarter of 2009

(38% based on the 2009 definition), 34% during the third quarter of 2009 (38% based on the 2009

definition) and 35% during the fourth quarter of 2009 (39% based on the 2009 definition). We are

not able to apply our revised definition and improved measurement processes and tools

retrospectively to our 2008 estimated industry mobile device volumes or our 2008 estimated volume

market share due to lack of visibility and data. The industry mobile device volumes estimated for

2008 and Nokia’s volume market share estimated for 2008 are not comparable with the industry

mobile device volumes estimates or Nokia’s volume market share estimates based on our revised

definition.

Applying our revised definition of the industry mobile device market applicable beginning in 2010 on

a comparable yearoveryear basis,

• we expect industry mobile device volumes to be up approximately 10% in 2010, compared to

2009;

• we target our mobile device volume market share to be flat in 2010, compared to 2009; and

• we target to increase our mobile device value market share slightly in 2010, compared to

2009.

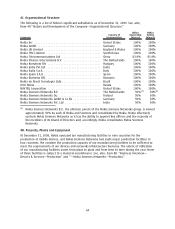

The mobile communications industry continues to undergo significant changes due to numerous

factors, including the increasing maturity of the traditional mobile phone market and the ongoing

digital convergence and the resulting growth of the converged mobile device market. In order to

address the different requirements of these markets, Nokia has established three sub units — Mobile

Phones, Smartphones and Mobile Computers. We apply a “product mode of operation” within Mobile

Phones and a “solutions mode of operation” within Smartphones and Mobile Computers.

• Our

product mode

of operation aims to ensure that we maintain our global market position in

the high volume mobile phone business. With the product mode of operation we seek to

satisfy consumers with affordable devices that embed selected services.

• Our focus in the

solutions mode

of operation is on the complete user experience and the

seamless integration of hardware, services, applications, content and context. Providing this

experience requires disciplined crosscompany execution and attractive platforms for partners,

thirdparty developers and content providers, as well as managing the consumer relationship

during the whole solution lifecycle with software updates and service promotions. This focus is

aimed at achieving high ASPs and margins, as well as driving additional services revenue.

We believe we have a number of competitive advantages, including scale, brand, manufacturing and

logistics, strategic sourcing and partnering, distribution, R&D and software platforms and intellectual

property.

•

Scale:

Our substantial scale contributes to our lower cost structure and our ability to invest in

innovation. In addition to manufacturing and logistics efficiencies and strategic sourcing and

partnering benefits that contribute to lower costs of goods sold, we are able to enjoy scale

efficiencies in our operating costs. For example, Nokia’s distribution and marketing efforts can

be spread across a broad portfolio of offerings in contrast to smaller competitors that often

focus on a specific geographical market, price segment or product category.

•

Brand:

As the devices business is a consumer business, brand is a major differentiating factor

with broad effects on market position and pricing. The Interbrand annual rating of 2009 Best

Global Brands positioned Nokia as the fifth mostvalued brand in the world for the third

consecutive year.

67