Nokia 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.performed in lower cost locations and lower restructuring charges. In 2008, R&D expenses included

restructuring charges and other items of EUR 46 million and purchase price accounting related items

of EUR 180 million. In 2007, R&D expenses included restructuring charges and other items of

EUR 439 million and purchase price accounting related items of EUR 136 million.

In 2008, Nokia Siemens Networks’ selling and marketing expenses increased to EUR 1 421 million

compared with EUR 1 394 million in 2007. Nokia Siemens Networks’ selling and marketing expenses

represented 9.3% of its net sales in 2008 compared with 10.4% in 2007. The increase in selling and

marketing expenses related to the fact that the results of Nokia Siemens Networks from January 1,

2007 to March 31, 2007 included our former Networks business group only. In 2008, selling and

marketing expenses included the reversal of restructuring charges and other items of EUR 14 million

and purchase price accounting related items of EUR 286 million. In 2007, selling and marketing

expenses included restructuring charges and other items of EUR 149 million and purchase price

accounting related items of EUR 214 million.

In 2008, other operating income and expenses included a restructuring charge and other items of

EUR 49 million and a gain of EUR 65 million from the transfer of Finnish pension liabilities to pension

insurance companies. In 2007, other operating income and expenses included a restructuring charge

and other items of EUR 58 million and a gain on sale of real estate EUR 53 million.

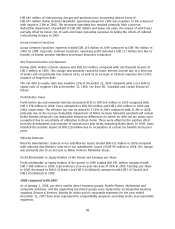

Nokia Siemens Networks 2008 operating loss was EUR 301 million compared to an operating loss of

EUR 1 308 million in 2007. In 2008, the operating loss included EUR 646 million of restructuring

charges and purchase price accounting related items of EUR 477 million. In 2007, the operating loss

included a charge of EUR 1 110 million related to Nokia Siemens Networks’ restructuring costs and

other items and a gain on sale of real estate of EUR 53 million. The operating loss in 2007 also

included EUR 570 million of intangible asset amortization and other purchase price accounting related

items. Nokia Siemens Networks’ operating margin for 2008 was negative 2.0% compared with

negative 9.8% in 2007. The decreased operating loss resulted primarily from higher net sales and

lower operating expenses and the impact of decreased restructuring charges and intangible asset

amortization and other purchase price accounting related items.

Corporate Common Functions

Corporate Common Functions’ expenses totaled EUR 396 million in 2008 compared with Corporate

Common Functions’ operating profit of EUR 1 709 million in 2007. In 2008, Corporate Common

Functions’ operating profit included a EUR 217 million loss due to transfer of Finnish pension

liabilities to pension insurance companies. In 2007, Corporate Common Functions’ operating profit

included a EUR 1 879 million nontaxable gain on the formation of Nokia Siemens Networks,

EUR 75 million of real estate gains and a EUR 53 million gain on a business transfer.

Net Financial Income and Expenses

During 2008, Nokia’s interest expense was EUR 2 million, compared with net financial income of

EUR 239 million in 2007. This change was primarily due to the increased interest expense as a result

of an increase in interestbearing liabilities incurred to finance the NAVTEQ acquisition. Foreign

exchange gains and losses increased due to a higher cost of hedging and increased volatility on the

foreign exchange market.

The net debt to equity ratio was negative 14% at December 31, 2008 compared with a net debt to

equity ratio of negative 62% at December 31, 2007. See Item 5B. “Liquidity and Capital Resources”

below.

Profit Before Taxes

Profit before tax and minority interests decreased 40% to EUR 4 970 million in 2008 compared with

EUR 8 268 million in 2007. Taxes amounted to EUR 1 081 million and EUR 1 522 million in 2008 and

2007, respectively. In 2008, taxes included the positive impact of EUR 128 million due to recognition

106