Nokia 2009 Annual Report Download - page 255

Download and view the complete annual report

Please find page 255 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

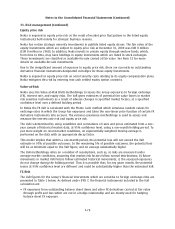

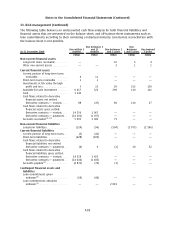

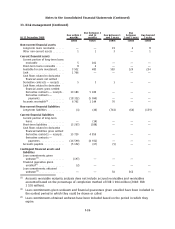

33. Risk management (Continued)

Business Related Credit Risk

The Company aims to ensure highest possible quality in accounts receivable and loans due from

customers and other third parties. The Group Credit Policy, approved by Group Executive Board, lays

out the framework for the management of the business related credit risks in all Nokia group

companies.

Credit exposure is measured as the total of accounts receivable and loans outstanding due from

customers and other third parties, and committed credits.

Group Credit Policy provides that credit decisions are based on credit evaluation including credit

rating for larger exposures. Nokia & Nokia Siemens Networks Rating Policy defines the rating

principles. Ratings are approved by Nokia & Nokia Siemens Networks Rating Committee. Credit risks

are approved and monitored according to the credit policy of each business entity. These policies are

based on the Group Credit Policy. Concentrations of customer or country risks are monitored at the

Nokia Group level. When appropriate, assumed credit risks are mitigated with the use of approved

instruments, such as collateral or insurance and sale of selected receivables.

The Group has provided impairment allowances as needed including on accounts receivable and loans

due from customers and other third parties not past due, based on the analysis of debtors’ credit

quality and credit history. The Group establishes an allowance for impairment that represents an

estimate of incurred losses. All receivables and loans due from customers and other third parties are

considered on an individual basis for impairment testing.

Top three customers account for approximately 2.2%, 2.2% and 1.9% (2008: 4.0%, 3.8% and 3.5%) of

Group accounts receivable and loans due from customers and other third parties as at 31 December,

2009, while the top three credit exposures by country amounted to 7.2%, 6.5% and 5.6% (2008:

8.5%, 7.2% and 7.2%), respectively.

As at 31 December, 2009, the carrying amount before deducting any impairment allowance of

accounts receivable relating to customers for which an impairment was provided amounted to

EUR 2 528 million (2008: EUR 3 042 million). The amount of provision taken against that portion of

these receivables considered to be impaired was EUR 391 million (2008: EUR 415 million) (see also

note 19 Valuation and qualifying accounts).

An amount of EUR 679 million (2008: EUR 729 million) relates to past due receivables from customers

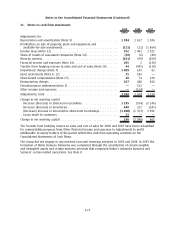

for which no impairment loss was recognized. The aging of these receivables is as follows:

2009 2008

EURm EURm

Past due 130 days ....................................................... 393 453

Past due 31180 days ..................................................... 170 240

More than 180 days....................................................... 116 36

679 729

The carrying amount of accounts receivable that would otherwise be past due or impaired but whose

terms have been renegotiated was EUR 36 million (EUR 0 million in 2008).

As at 31 December, 2009, the carrying amount before deducting any impairment allowance of loans

due from customers and other third parties for which impairment was provided amounted to

EUR 4 million (2008: EUR 4 million). The amount of provision taken for these loans was EUR 4 million

(2008: EUR 4 million).

There were no past due loans from customers and other third parties.

F81

Notes to the Consolidated Financial Statements (Continued)