Nokia 2009 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

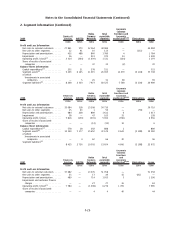

4. Personnel expenses (Continued)

2009 2008 2007

Average personnel

Devices & Services ....................................... 56 462 57 443 49 887

NAVTEQ................................................ 4 282 3 969 —

Nokia Siemens Networks .................................. 62 129 59 965 50 336

Group Common Functions ................................. 298 346 311

Nokia Group ............................................ 123 171 121 723 100 534

5. Pensions

The Group operates a number of postemployment plans in various countries. These plans include

both defined contribution and defined benefit schemes.

The Group’s most significant defined benefit pension plans are in Germany and in the UK. The

majority of active employees in Germany participate in a pension scheme which is designed according

to the Beitragsorientierte Siemens Altersversorgung (“BSAV”). The funding vehicle for the BSAV is the

NSN Pension Trust. In Germany, individual benefits are generally dependent on eligible compensation

levels, ranking within the Group and years of service.

The majority of active employees in Nokia UK participate in a pension scheme which is designed

according to the Scheme Trust Deeds and Rules and is compliant with the Guidelines of the UK

Pension Regulator. The funding vehicle for the pension scheme is Nokia Group (UK) Pension Scheme

Ltd which is run on a Trust basis. In the UK, individual benefits are generally dependent on eligible

compensation levels and years of service for the defined benefit section of the scheme and on

individual investment choices for the defined contribution section of the scheme.

In prior years, the Group had a significant pension plan in Finland. Prior to March 1, 2008, the

reserved benefits portion of the Finnish state Employees’ Pension Act (“TyEL”) system, that was pre

funded through a trusteeadministered Nokia Pension Foundation, was accounted for as a defined

benefit plan. As of March 1, 2008 the Finnish statutory pension liability and plan related assets of

Nokia and Nokia Siemens Networks were transferred to two pension insurance companies. The

transfer did not affect the number of employees covered by the plan nor did it affect the current

employees’ entitlement to pension benefits.

At the transfer date, the Group has not retained any direct or indirect obligation to pay employee

benefits relating to employee service in current, prior or future periods. Thus, the Group has treated

the transfer of the Finnish statutory pension liability and plan assets as a settlement of the Group’s

TyEL defined benefit plan. From the date of transfer onwards, the Group has accounted for the TyEL

plan as a defined contribution plan. The transfer resulted in EUR 152 million loss consisting of a

EUR 217 million loss impacting Common Group Functions and a EUR 65 million gain impacting Nokia

Siemens Networks operating profit. These are included in the other operating income and expense,

see Note 6. Subsequent to the transfer of the Finnish statutory pension liability and plan assets, the

Group retains only certain immaterial voluntary defined benefit pension liabilities in Finland.

F29

Notes to the Consolidated Financial Statements (Continued)