Nokia 2009 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

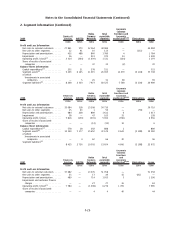

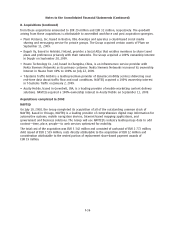

5. Pensions (Continued)

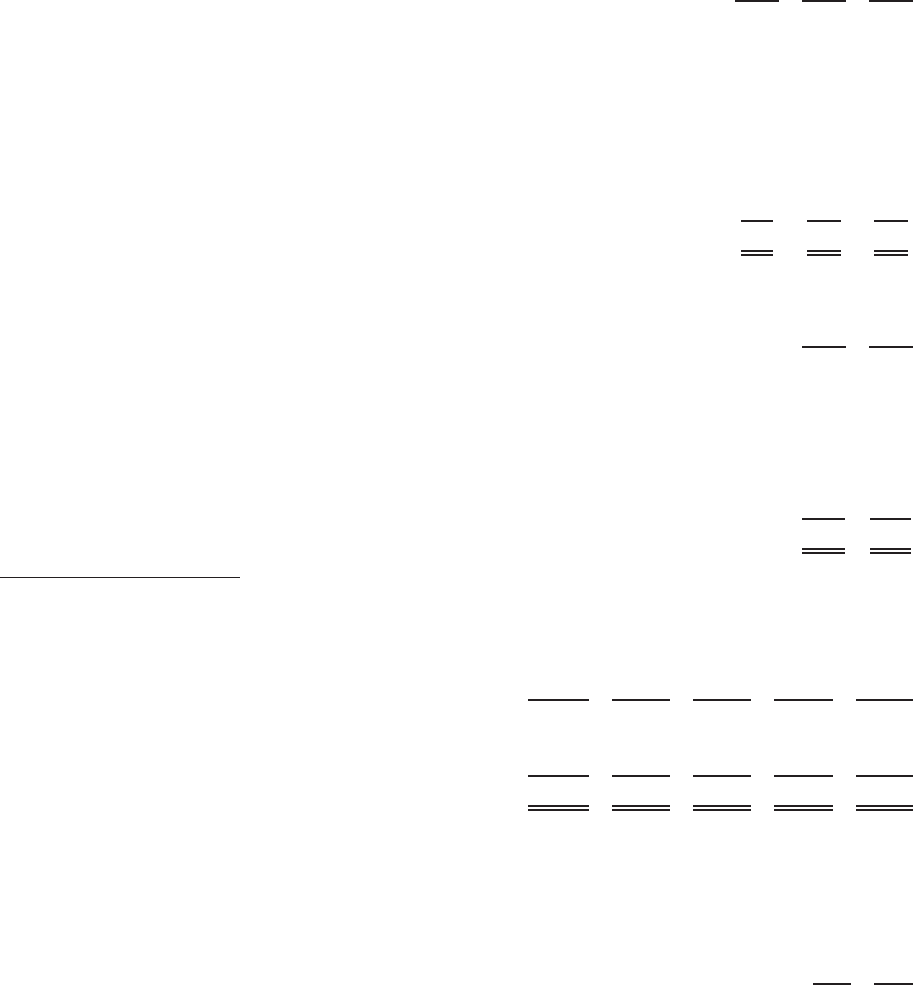

The amounts recognized in the income statement are as follows:

2009 2008 2007

EURm EURm EURm

Current service cost ................................................. 55 79 125

Interest cost ....................................................... 69 78 104

Expected return on plan assets ........................................ (70) (71) (95)

Net actuarial (gains) losses recognized in year ........................... (9) —10

Impact of paragraph 58(b) limitation ................................... 5——

Past service cost (gain) loss........................................... —2—

Curtailment ....................................................... —(12) (1)

Settlement ........................................................ —152 (12)

Total, included in personnel expenses .................................. 50 228 131

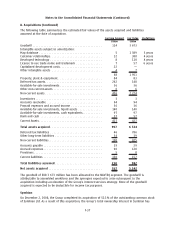

Movements in prepaid (accrued) pension costs recognized in the statement of financial position are as

follows:

2009 2008

EURm EURm

Prepaid (accrued) pension costs at beginning of year ............................ (120) (36)

Net income (expense) recognized in the profit and loss account.................... (50) (228)

Contributions paid ........................................................ 49 141

Benefits paid . ........................................................... 16 12

Acquisitions . . ........................................................... 13

Foreign exchange......................................................... (2) (12)

Prepaid (accrued) pension costs at end of year* ................................ (106) (120)

* included within prepaid expenses and accrued income / accrued expenses

The prepaid pension cost above is made up of a prepayment of EUR 68 million (EUR 55 million in

2008) and an accrual of EUR 174 million (EUR 175 million in 2008).

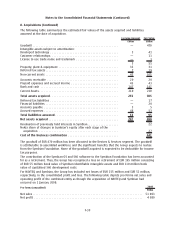

2009 2008 2007 2006 2005

EURm EURm EURm EURm EURm

Present value of defined benefit obligation ........... (1 411) (1 205) (2 266) (1 577) (1 385)

Plan assets at fair value ........................... 1 330 1 197 2 174 1 409 1 276

Surplus/(Deficit) ................................. (81) (8) (92) (168) (109)

Experience adjustments arising on plan obligations amount to a loss of EUR 12 million in 2009 (gain

of EUR 50 million in 2008, a loss of EUR 31 million in 2007 and EUR 25 million in 2006). Experience

adjustments arising on plan assets amount to a gain of EUR 54 million in 2009 (a loss of

EUR 22 million in 2008, EUR 3 million in 2007 and EUR 11 million in 2006).

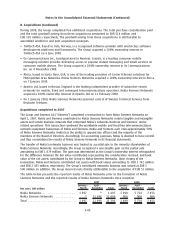

The principal actuarial weighted average assumptions used were as follows:

2009 2008

%%

Discount rate for determining present values .................................... 5.3 5.8

Expected longterm rate of return on plan assets ................................ 5.4 5.7

Annual rate of increase in future compensation levels ............................. 2.8 2.7

Pension increases ......................................................... 2.0 1.9

F31

Notes to the Consolidated Financial Statements (Continued)