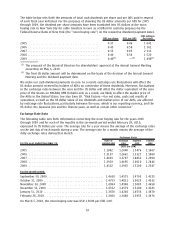

Nokia 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.may have a dilutive effect on our profits; the future valuations of acquired businesses may decrease

from the purchase price we paid and result in impairment charges related to goodwill or other

acquired assets; and if all or a portion of the purchase price is paid in cash, this may have an adverse

effect on our cash position. Moreover, due to our financial targets and need to manage costs and

prioritize our investments, future investments in our converged mobile devices may be delayed or

insufficient to reach or maintain the necessary scale and market position to compete effectively and

profitably in the longer term.

Competition in the various markets where we do business—traditional mobile devices,

converged mobile devices, digital map data and related locationbased content, and mobile

and fixed network infrastructure and related services—is intense. Our failure to maintain or

improve our market position or respond successfully to changes in the competitive

environment in those markets may have a material adverse effect on our business, sales and

results of operations.

We experience intense competition in every aspect of our business and across all markets of our

products and services and their combinations. The mobile communications industry continues to

undergo significant changes due to numerous factors, including the increasing maturity of the

traditional mobile device market and the ongoing digital convergence and the resulting growth of the

converged mobile device and related services market. Overall, participants in the mobile device

market compete with each other on the basis of their product and services portfolio, including design,

functionalities, breadth of services, user experience, software, quality, compatibility, technical

performance and price; operational and manufacturing efficiency; supply chain efficiency, including

sourcing, logistics and distribution; marketing; customer support; and brand. However, mobile device

markets are increasingly segmented and diversified, and we face competition from a growing number

of participants in different user segments, price points and geographical markets as well as layers of

the product using different competitive means in each of them. This may make it more difficult and

less cost efficient for us to compete successfully across the whole mobile device market against more

specialized competitors and to leverage our scale and other competitive advantages to the fullest

extent. The increased segmentation and diversification of the mobile device market may also have a

negative impact on our ability to accurately estimate and forecast the global and regional industry

volumes and value of the mobile device market and, consequently, the actual industry volumes and

value of the mobile device market may from time to time be higher or lower than estimated or

forecasted by us.

Traditional Mobile Devices:

Competition continues to be intense in the traditional mobile device

market from both traditional mobile device manufactures, as well as other participants such as

mobile network operators offering devices under their own brand. In this market, participants

compete primarily on the basis of the lowest total cost of ownership for basic voice and messaging

mobile phones, as well as the ability to offer mobile phones that balance cost of ownership with style

and added locally relevant functionality, such as Internet connectivity, applications and content. Some

of our competitors, particularly new entrants, have used, and we expect will continue to use, more

aggressive pricing and marketing strategies, different design approaches and alternative technologies

which consumers may prefer over our offering of mobile phones.

Additionally, some competitors have chosen to focus on building mobile phones based on

commercially available components, software and content, in some cases available at very low or no

cost, which may enable them, at times, to introduce their products and services faster and at

significantly lower cost to them and the consumer than we may be able to do. More recently, we are

facing competition from vendors of both legitimate, as well as unlicensed and counterfeit, products

with manufacturing facilities primarily centered around certain locations in Asia and other emerging

markets. The entry barriers for these new market entrants are relatively low as they are able to take

advantage of licensed and unlicensed commercially available free or low cost components, software

and content. Some of our competitors may also benefit from governmental support in their home

countries and other measures that may have protectionist objectives. These factors could reduce the

15