Nokia 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.entered against the Uzans once certain appeal issues have been resolved. We wrote off our total

financing exposure to Telsim prior to 2003.

In 1999, Nokia entered into a license agreement with InterDigital Technology Corporation (IDT) for

certain technology that provided for a fixed royalty payment through 2001 and most favored

licensee treatment from 2002 through 2006. The patents being licensed were subject to litigation

by other manufacturers. In March 2003, IDT settled patent litigation with Ericsson and Sony-

Ericsson and announced that it intended to apply the settlement royalty rates to Nokia under the

most favored licensee provision. After failed attempts at negotiating a settlement, Nokia filed an

arbitration demand seeking access to information necessary to an evaluation of the matter that

has been withheld by IDC. IDC has responded with a counterclaim seeking to apply the Ericsson

and Sony-Ericsson royalty rates to Nokia. Nokia believes that the claim is without merit and

intends to defend the matter vigorously.

Based upon the information currently available, management does not expect the resolution of

any of the matters discussed above to have a material adverse effect on our financial condition or

results of operations.

8.A.8 See ‘‘Item 3.A Selected Financial Data—Distribution of Earnings’’ for a discussion of our

dividend policy.

8.B Significant Changes

No significant changes have occurred since the date of our consolidated financial statements

included in this Form 20-F. See ‘‘Item 5.D Trend Information.’’

ITEM 9. THE OFFER AND LISTING

9.A Offer and Listing Details

Our capital consists of shares traded on the Helsinki Exchanges under the symbol ‘‘NOK1V.’’

American Depositary Shares, or ADSs, each representing one of our shares are traded on the New

York Stock Exchange under the symbol ‘‘NOK.’’ The ADSs are evidenced by American Depositary

Receipts, or ADRs, issued by Citibank, N.A., as Depositary under the Amended and Restated Deposit

Agreement dated as of March 28, 2000 (as amended), among Nokia, Citibank, N.A. and registered

holders from time to time of ADRs. ADSs were first issued in July 1994.

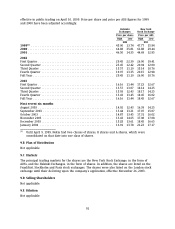

The table below sets forth, for the periods indicated, the reported high and low quoted prices for

our shares on the Helsinki Exchanges and the high and low quoted prices for the shares, in the

form of ADSs, on the New York Stock Exchange. In 1999, Nokia effected a two-for-one share split,

effective in public trading on April 12, 1999. In 2000, Nokia effected a four-for-one share split,

90