Nokia 2003 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

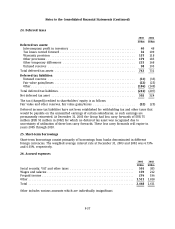

Notes to the Consolidated Financial Statements (Continued)

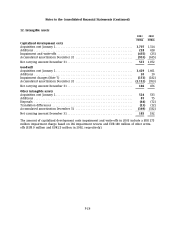

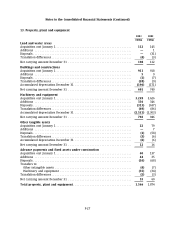

14. Investments in associated companies

2003 2002

EURm EURm

Net carrying amount January 1 ........................................... 49 49

Additions ............................................................ 59 24

Share of results ....................................................... (18) (19)

Translation differences .................................................. (2) 1

Other movements ...................................................... (12) (6)

Net carrying amount December 31 ........................................ 76 49

In 2003 Nokia increased its ownership in Symbian from 19.0% to 32.2% by acquiring part of the

shares of Symbian owned by Motorola representing 13.2% of all the shares in Symbian, for EUR 57

million (GBP 39.6 million) in cash.

In 2001, Nextrom Holding S.A. was accounted for under the equity method. Due to the increase of

Nokia’s ownership in 2002 Nextrom Holding S.A. has been fully consolidated for accounting

purposes from the date of increased ownership which is reflected in other movements.

Shareholdings in associated companies are comprised of investments in unlisted companies in

2003 and 2002.

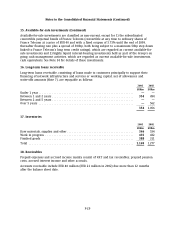

15. Available-for-sale investments

2003 2002

EURm EURm

Fair value at January 1 ................................................ 8,093 4,670

Additions, net ....................................................... 2,911 3,587

Net fair value gains/(losses) ............................................ 111 (87)

Impairment charges (Note 7) ........................................... (27) (77)

Fair value at December 31 ............................................. 11,088 8,093

Non-current ........................................................ 121 238

Current ............................................................ 816 —

Current, cash equivalents .............................................. 10,151 7,855

Available-for-sale investments, comprising marketable debt and equity securities and investments

in unlisted equity shares, are fair valued, except in the case of certain unlisted equities, where the

fair value cannot be measured reliably. Such unlisted equities are carried at cost, less impairment

(EUR 45 million in 2003 and EUR 48 million in 2002). Fair value for equity investments traded in

active markets and for unlisted equities, where the fair value can be measured reliably, is EUR 77

million in 2003 and EUR 190 million in 2002. Fair value for equity investments traded in active

markets is determined by using exchange quoted bid prices. For other investments, fair value is

estimated by using the current market value of similar instruments or by reference to the

discounted cash flows of the underlying net assets.

Gains and losses arising from the change in the fair value of available-for-sale investments are

recognized directly in fair value and other reserves.

F-28