Nokia 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.our investments in building the Nokia brand and our marketing activities, see ‘‘Item 4.B Business

Overview—Sales and Marketing.’’

At the end of 2003, we employed 51 359 people world-wide, compared to 51 748 and 53 849 at

December 31, 2002 and 2001, respectively. In 2003, our personnel decreased by a net total of 389

employees as a result of restructuring at Nokia Networks, offset by recruitment mainly in research

and development at Nokia Mobile Phones. In 2002, we decreased our personnel by 2 101, mainly

as a result of outsourcing and restructuring at Nokia Networks and Nokia Ventures Organization.

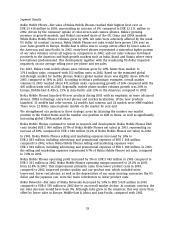

2003 compared to 2002

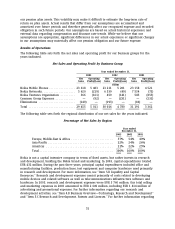

Nokia Net Sales and Operating Profit

In 2003, economic conditions started to improve in the US and elsewhere in the Americas, and in

the latter part of the year the Asia-Pacific market also began to show signs of recovery. In the

main European markets, weak economic conditions continued. The US dollar continued to

depreciate against the euro, falling by 17% in 2003 (year-end rate compared to year-end rate for

the previous year). This currency development had a material negative impact on our net sales

expressed in euros because approximately 50% of our net sales are generated in US dollars and

currencies closely following the US dollar. For more information, see ‘‘—Exchange Rates’’ below.

Our net sales totaled EUR 29 455 million in 2003 and EUR 30 016 million in 2002, representing a

decrease of 2% in 2003. At constant currency, net sales would have grown 7% year on year. Our

gross margin in 2003 improved to 41.5% compared to 39.1% in 2002, with the improvement

coming primarily from Nokia Mobile Phones and to a lesser extent from Nokia Networks. In 2003,

the clear improvement in the quality of our mobile phones resulted in a lower quality cost per

phone than in 2002. Also the product mix consisted of slightly more lower-end phones with lower

product costs, and contributed to a lower average cost per phone. Depreciation of the US dollar

and also the Japanese yen also contributed to a lower average cost per phone because more than

50% of our mobile phone components are sourced in US dollars and approximately 25% in

Japanese yen. All these factors together decreased cost of sales in Nokia Mobile Phones. In Nokia

Networks, quality in our network deliveries improved towards the end of the year impacting

positively on the gross margin. Also the product mix as well as the depreciation of sourcing

currencies contributed to higher margins than in 2002.

Our operating profit increased by 5% to EUR 5 011 million in 2003, compared to EUR 4 780 million

in 2002, as a result of the increase in our gross margins, as described in the previous paragraph.

Our operating margin was 17.0% in 2003, compared to 15.9% in 2002. We continued to invest

significantly in research and development. R&D expenses totaled EUR 3 760 million in 2003, an

increase of 23% from 2002 (EUR 3 052 million). If personnel related restructuring costs

(EUR 15 million) as well as impairments and write-offs of capitalized R&D costs (EUR 455 million)

in Nokia Networks totaling EUR 470 million were excluded, the increase in R&D expenses would

have been 8%. R&D expenses represented 12.8% of net sales in 2003, compared to 10.2% of net

sales in 2002. Excluding the restructuring costs, impairments and write-offs in Nokia Networks,

R&D expenses would have represented 11.2% of net sales in 2003.

In 2003, Nokia’s operating profit included the following exceptional items, each within Nokia

Networks: a positive adjustment of EUR 226 million as a result of the customer finance

impairment recorded in 2002 related to MobilCom, the above mentioned R&D related costs totaling

EUR 470 million, other restructuring costs of EUR 80 million, as well as a goodwill impairment of

EUR 151 million. The goodwill impairment charge related to Nokia Networks’ Core Networks

business. The positive adjustment related to MobilCom is discussed below under ‘‘—Segment

Results—Nokia Networks’’ and ‘‘Item 5.B Liquidity and Capital Resources—Customer Financing.’’

52