Nokia 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Profit Before Taxes

Profit before taxes and minority interests increased 41% and totaled EUR 4 917 million in 2002

compared to EUR 3 475 million in 2001. Taxes amounted to EUR 1 484 million and

EUR 1 192 million in 2002 and 2001, respectively.

Minority Interests

Minority shareholders’ interest in our subsidiaries’ profits totaled EUR 52 million in 2002 compared

to EUR 83 million in 2001.

Net Profit and Earnings per Share

Net profit in 2002 increased to EUR 3 381 million, compared to EUR 2 200 million in 2001,

representing a year-on-year increase in net profit of 54% in 2002. Basic earnings per share

increased to EUR 0.71 in 2002 compared to EUR 0.47 in 2001.

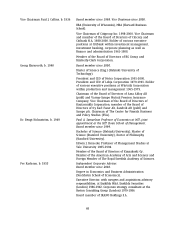

Related Party Transactions

There have been no material transactions during the last three fiscal years to which any director,

executive officer or 5% shareholder, or any relative or spouse of any of them, was party. There is

no significant outstanding indebtedness owed to Nokia by any director, executive officer or 5%

shareholder.

There are no material transactions with enterprises controlling, controlled by or under common

control with Nokia or associate of Nokia.

See Notes 31 and 32 to our consolidated financial statements included in Item 18 of this

Form 20-F.

Exchange Rates

Nokia’s business and results of operations are from time to time affected by changes in exchange

rates, particularly between the euro and other currencies such as the US dollar, the Japanese yen

and the UK pound sterling. See ‘‘Item 3.A Selected Financial Data—Exchange Rate Data.’’ Foreign

currency denominated assets and liabilities, together with highly probable purchase and sale

commitments, give rise to foreign exchange exposure. In general, depreciation of another currency

relative to the euro has an adverse effect on Nokia’s sales and operating profit, while appreciation

of another currency has a positive effect, with the exception of Japanese yen, being the only

significant foreign currency in which Nokia has more purchases than sales.

During 2003 and 2002, both the US dollar as well as the UK pound sterling depreciated (average

rate for the year compared to average rate for the previous year) against the euro. The US dollar

with approximately 16.1% and 6.1%, respectively, and the UK pound sterling with approximately

9.1% and 1.5%, respectively. In 2001, the US dollar appreciated approximately 3.3% and the UK

pound sterling depreciated approximately 1.6% against the euro. The change in value of the US

dollar and the UK pound sterling had a slightly negative impact on Nokia’s operating profit in

2003 and 2002, and slightly positive effect in 2001. In 2003, 2002 as well as 2001, the Japanese yen

depreciated approximately 9.8%, 7.7% and 8.6%, respectively against the euro, which had a

slightly positive impact on our operating profit, due to the fact that Nokia had net purchases in

Japanese yen.

The continued strengthening of the euro, if prolonged against currencies in which we have

revenues, particularly the US dollar, will have an increasingly significant impact on our sales

expressed in euros. In addition to the impact of exchange rate fluctuations on our results of

58