Nokia 2003 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

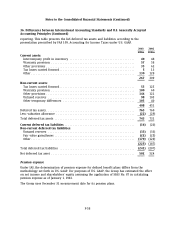

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

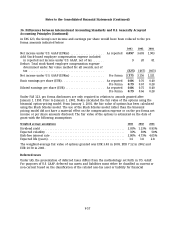

Under U.S. GAAP, related party transactions in 2002 with the subsidiary included sales by Nokia to

the subsidiary of EUR 1,462 million (EUR 2,090 million in 2001) and purchases by Nokia from the

subsidiary of EUR 2,090 million (EUR 1,536 million in 2001).

New US Accounting Standards

In May 2003, the FASB issued SFAS 150, Accounting for Certain Financial Instruments with

Characteristics of both Liabilities and Equity (FAS 150). The statement establishes standards on

how to classify and measure certain financial instruments with characteristics of both liabilities

and equity and requires additional disclosures regarding alternative ways of settling instruments

and the capital structure of entities—all of whose shares are mandatory redeemable. The

provisions of FAS 150 were effective for all financial instruments entered into or modified after

May 31, 2003, and otherwise was effective the first interim period beginning after June 15, 2003.

However, the guidance applying to mandatorily redeemable noncontrolling interests has been

deferred. The Company does not expect this statement to have a material impact on the financial

statements.

In April 2003, the FASB issued SFAS 149, Amendment of Statement 133 on Derivative Instruments

and Hedging Activities (FAS 149). FAS 149 generally improves financial reporting for derivative

instruments by requiring that contracts with comparable characteristics be accounted for similarly

and by clarifying when a derivative contains a financing component that warrants special

reporting in the statement of cash flows. The guidance in SFAS 149 was effective prospectively for

contracts entered into or modified and for hedging relationships designated after June 30, 2003.

The Company has evaluated the impact of this statement and does not expect it to have a material

impact on the financial statements.

In December 2003 the Financial Accounting Standards Board issued FASB Interpretation No.46 R,

Consolidation of Variable Interest Entities Revised. FIN 46R modifies the scope exceptions

provided in FIN 46. Entities would be required to replace FIN 46 provisions with FIN 46R

provisions for all newly created post-January 31, 2003 entities as of the end of the first interim or

annual reporting period ending after March 15, 2004. We reviewed our investment portfolio,

including associated companies, and identified no investments in Variable Interest Entities, as

defined by FIN 46. However, we have identified that at December 31, 2003, Nokia is a variable

interest holder as defined by FIN 46 in a reinsurance company that was formed in connection

with its multi-line multi-year insurance program. This holding is represented by a call option on

the company’s shares and is fair valued in Nokia’s financial statements through the profit and loss

accounts. At December 31, 2003, the fair value of the option was EUR 25 million. Nokia’s exposure

to any additional loss is negligible.

F-63