Nokia 2003 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-33

Notes to the Consolidated Financial Statements (Continued)

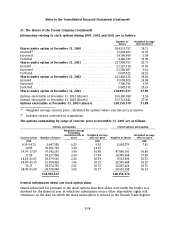

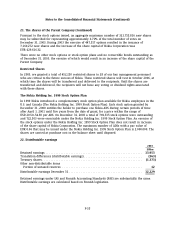

21. The shares of the Parent Company (Continued)

Convertible bonds and stock options

The following table depicts the main features of our outstanding stock option plans, which may result in the increase of our share

capital. The increase in share capital resulted by these stock options is the number of shares to be issued times the nominal value of

each share. The plans have been approved by the Annual General Meetings in the year of the launch of the plan.

Outstanding stock option plans, December 31, 2003(1)

Total plan

size

(Maximum Number of Subscription periods

Plan no. participants Exercise Exercise

(Year of launch) of shares) (Approximately) (Sub)category Vesting schedule Starting Ending price/option price/share Split ratio

1999 144,000,000 16,000 A Vested April 1, 2001 December 31, 2004 67.55 EUR 16.89 EUR 4:1

B Vested April 1, 2002 December 31, 2004 225.12 EUR 56.28 EUR 4:1

C Vested April 1, 2003 December 31, 2004 116.48 EUR 29.12 EUR 4:1

2001 145,000,000 25,000 2001A+B 25% vest 1 year after grant; July 1, 2002 December 31, 2006 36.75 EUR 36.75 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2001C3Q/01 25% vest 1 year after grant; October 1, 2002 December 31, 2006 20.61 EUR 20.61 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2001C4Q/01 25% vest 1 year after grant; January 1, 2003 December 31, 2006 26.67 EUR 26.67 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2001C1Q/02 25% vest 1 year after grant; April 1, 2003 December 31, 2007 26.06 EUR 26.06 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2001C3Q/02 25% vest 1 year after grant; October 1, 2003 December 31, 2007 12.99 EUR 12.99 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2001C4Q/02 25% vest 1 year after grant; January 1, 2004 December 31, 2007 16.86 EUR 16.86 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2002A+B 25% vest 1 year after grant; July 1, 2003 December 31, 2007 17.89 EUR 17.89 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2003 94,600,000 22,846 2003 2Q 25% vest 1 year after grant; July 1, 2004 December 31, 2008 14.95 EUR 14.95 EUR 1:1

6.25% in 12 subsequent quarterly blocks

2003 3Q 25% vest 1 year after grant; October 1, 2004 December 31, 2008 12.71 EUR 12.71 EUR 1:1

6.25% in 12 subsequent quarterly blocks

(1) Figures have been recalculated to reflect the par value of EUR 0.06 of the shares.

Note. All vested stock options are listed on the Helsinki Exchanges (HEX).