Nokia 2003 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

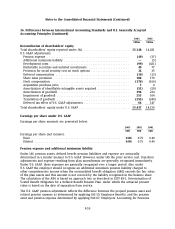

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

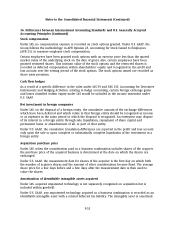

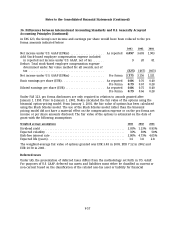

The following table shows the results of operations as if FAS 142 were applied to prior periods:

2001

EURm

(except per

share amounts)

Net income as reported under U.S. GAAP .................................. 1,903

Add back: Goodwill amortization ........................................ 274

Adjusted net income .................................................. 2,177

Income per share—Basic

Net income as reported under U.S. GAAP ................................ 0.40

Goodwill amortization .............................................. 0.06

Adjusted net income ................................................ 0.46

Income per share—Diluted

Net income as reported under U.S. GAAP ................................ 0.40

Goodwill amortization .............................................. 0.06

Adjusted net income ................................................ 0.45

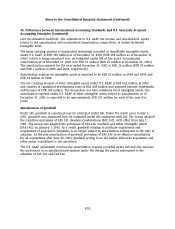

Impairment of goodwill

The Group has evaluated its existing goodwill relating to prior business combinations and has

determined that an adjustment or reclassification to intangible assets as of January 1, 2002 was

not required in order to conform to the new criteria in FAS 141. The Group has also reassessed the

useful lives and carrying values of other intangible assets, and will continue to amortize these

assets over their remaining useful lives.

As of January 1, 2002, the Group performed the transitional impairment test under FAS 142 and

compared the carrying value for each reporting unit to its fair value, which was determined based

on discounted cash flows. Upon completion of the transitional impairment test, the Group

determined that there was no impairment as of January 1, 2002, as the carrying value of each

reporting unit did not exceed its fair value. The Group has also completed the annual impairment

test required by FAS 142 during the fourth quarter of 2003 and 2002, which was also performed

by comparing the carrying value of each reporting unit to its fair value based on discounted cash

flows.

Under IAS, goodwill is allocated to ‘‘cash generating units’’, which are the smallest group of

identifiable assets which includes the goodwill under review for impairment, and that generates

cash inflows from continuing use that are largely independent of the cash inflows from other

assets. Under IAS, the Group recorded in 2003 and 2002 an impairment of goodwill of

EUR 151 million and EUR 104 million, respectively, related to Amber Networks as the carrying

amount of the cash generating unit exceeded the recoverable amount of the unit. Upon completion

of the annual impairment test, the Group determined that the impairment recorded for Amber

Networks should be reversed for U.S. GAAP purposes because, at the Core Networks reporting unit

level in 2003 and IP Mobility Network reporting unit level in 2002, where Amber Networks

resides, the fair value of the reporting unit exceeded the book value of the reporting unit.

F-54