Nokia 2003 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

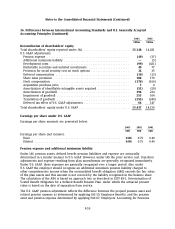

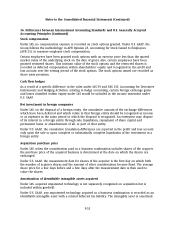

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

Segment information

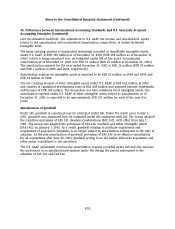

The accounting policies of the segments are the same as those described in Note 1, Accounting

principles. Nokia accounts for intersegment revenues and transfers as if the revenues or transfers

were to third parties, and therefore at current market prices. Nokia evaluates the performance of

its segments and allocates resources to them based on operating profit.

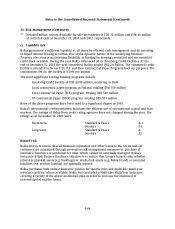

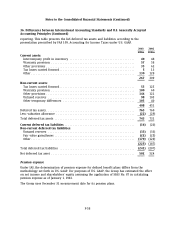

2003 2002 2001

EURm EURm EURm

Long lived assets by location of assets(1):

Finland ....................................................... 807 932 1,161

USA.......................................................... 120 180 299

Great Britain .................................................. 152 189 227

China ........................................................ 116 168 266

Germany ..................................................... 117 137 182

Other ........................................................ 254 268 379

Group ........................................................ 1,566 1,874 2,514

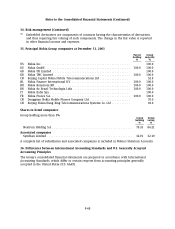

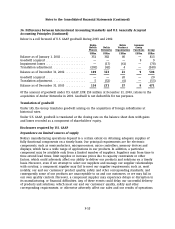

2003 2002 2001

EURm EURm EURm

Capital additions to long lived assets(1):

Nokia Mobile Phones ............................................ 281 212 362

Nokia Networks ................................................ 36 82 264

Nokia Ventures Organization ...................................... 349

Common Group Functions ........................................ 30 67 296

Group ........................................................ 350 365 931

(1) Long-lived assets include property, plant and equipment.

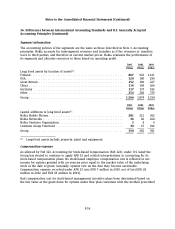

Compensation expense

As allowed by FAS 123, Accounting for Stock-Based Compensation (FAS 123), under U.S. GAAP the

Group has elected to continue to apply APB 25 and related interpretations in accounting for its

stock-based compensation plans. No stock-based employee compensation cost is reflected in net

income for options granted with an exercise price equal to the market value of the underlying

stock at the date of grant. Generally, options vest on the date they become exercisable.

Compensation expense recorded under APB 25 was EUR 7 million in 2003, net of tax (EUR 28

million in 2002 and EUR 85 million in 2001).

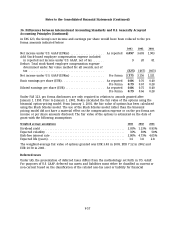

Had compensation cost for stock-based management incentive plans been determined based on

the fair value at the grant dates for options under that plan consistent with the method prescribed

F-56