Nokia 2003 Annual Report Download - page 64

Download and view the complete annual report

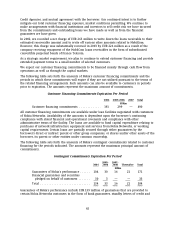

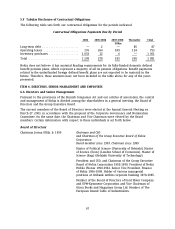

Please find page 64 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other similar instruments. These instruments entitle the customer to claim payment as

compensation for non-performance by Nokia of its obligations under network infrastructure

supply agreements. Depending on the nature of the instrument, compensation is payable either

immediately upon request, or subject to independent verification of non-performance by Nokia.

Financial guarantees and securities pledged on behalf of customers represent guarantees relating

to payment by certain Nokia Networks customers under specified loan facilities between such

customers and their creditors. Nokia’s obligations under such guarantees are released upon the

earlier of expiration of the guarantee or early payment by the customer.

Please see Note 29 to our consolidated financial statements for further information regarding

commitments and contingencies.

5.C Research and Development, Patents and Licenses

Success in the mobile communications industry requires continuous introduction of new products

and solutions based on the latest available technology. This places considerable demands on our

research and development activities. Consequently, in order to maintain our competitiveness, we

have made substantial research and development expenditures in each of the last three years. Our

consolidated research and development costs for 2003 were EUR 3 760 million, an increase of 23%

over 2002 (EUR 3 052 million) and an increase of 2% in 2002 compared to 2001 (EUR 2 985

million). These costs represented 12.8%, 10.2% and 9.6% of net sales in 2003, 2002 and 2001,

respectively. During 2003, Nokia Networks took action to improve profitability, by ceasing certain

ongoing research and development projects, resulting in a reduction of the number of R&D

employees. Nokia Networks did this to bring sharper focus and lower cost to research and

development, and to position Nokia Networks for long-term profitability. If the restructuring costs,

impairments and write-offs of capitalized R&D costs in Nokia Networks totaling EUR 470 million

were excluded, the R&D costs of Nokia Group would have represented 11.2% of net sales in 2003.

To enable our future growth, we continued to invest in our worldwide research and development

network, as well as increasing our collaboration with third parties. At December 31, 2003, we

employed 19 849 people in research and development in 19 countries, representing approximately

39% of Nokia’s total workforce, and had research and development centers in 11 countries.

Research and development expenses of Nokia Mobile Phones as a percentage of its net sales were

8.7% in 2003, 8.1% in 2002 and 6.9% in 2001. In the case of Nokia Networks, research and

development costs represented 27.4%, 15.2% and 15.1% of its net sales in 2003, 2002 and 2001,

respectively. If the restructuring costs, impairments and write-offs totaling EUR 470 million

described in the previous paragraph were excluded, the R&D costs of Nokia Networks would have

represented 19.0% of net sales in 2003. See ‘‘Item 4.B Business Overview—Technology, Research

and Development’’ and ‘‘—Patents and Licenses.’’

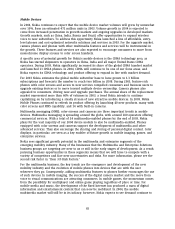

5.D Trend Information

General

During the past years, Nokia’s business and results of operations have been affected by a number

of important trends. The rapid growth in the global mobile communications market has been

spurred by the digitalization and convergence of voice and data transmission. In 2001, the mobile

communications industry experienced a year of transition leading to a market decline. However,

growth started to emerge in 2002 with the launch of feature-rich multimedia products offering

new advanced mobile services.

In 2003, mobile phone volumes continued to increase, growing by 16% to 471 million units,

according to Nokia’s preliminary estimates, compared to an estimated 405 million units in 2002.

63